The last-mile industry plays a key role in keeping goods moving across the country, making it an essential part of the supply chain. However, one of the longstanding challenges faced by this industry is low driver retention rates. High turnover rates have a significant impact on the operations of courier companies. While there are a variety of factors that contribute to driver turnover, one key aspect that stands out is the drivers’ take-home pay.

Importance of driver compensation

Self-employed driver’s take-home pay is one of the most important factors directly affecting how satisfied a driver is and their decision to stay with a particular courier company. Having a good income not only allows drivers to feel rewarded for their hard work but also improves their quality of life. When self-employed drivers feel they are fairly compensated, they are more likely to remain engaged, motivated, and committed to their jobs, leading to increased driver retention rates. Self-employed drivers who are struggling to make ends meet due to low pay are more likely to seek alternative employment options, contributing to the industry’s high turnover rates.

Strategies to boost take-home pay and improve driver retention

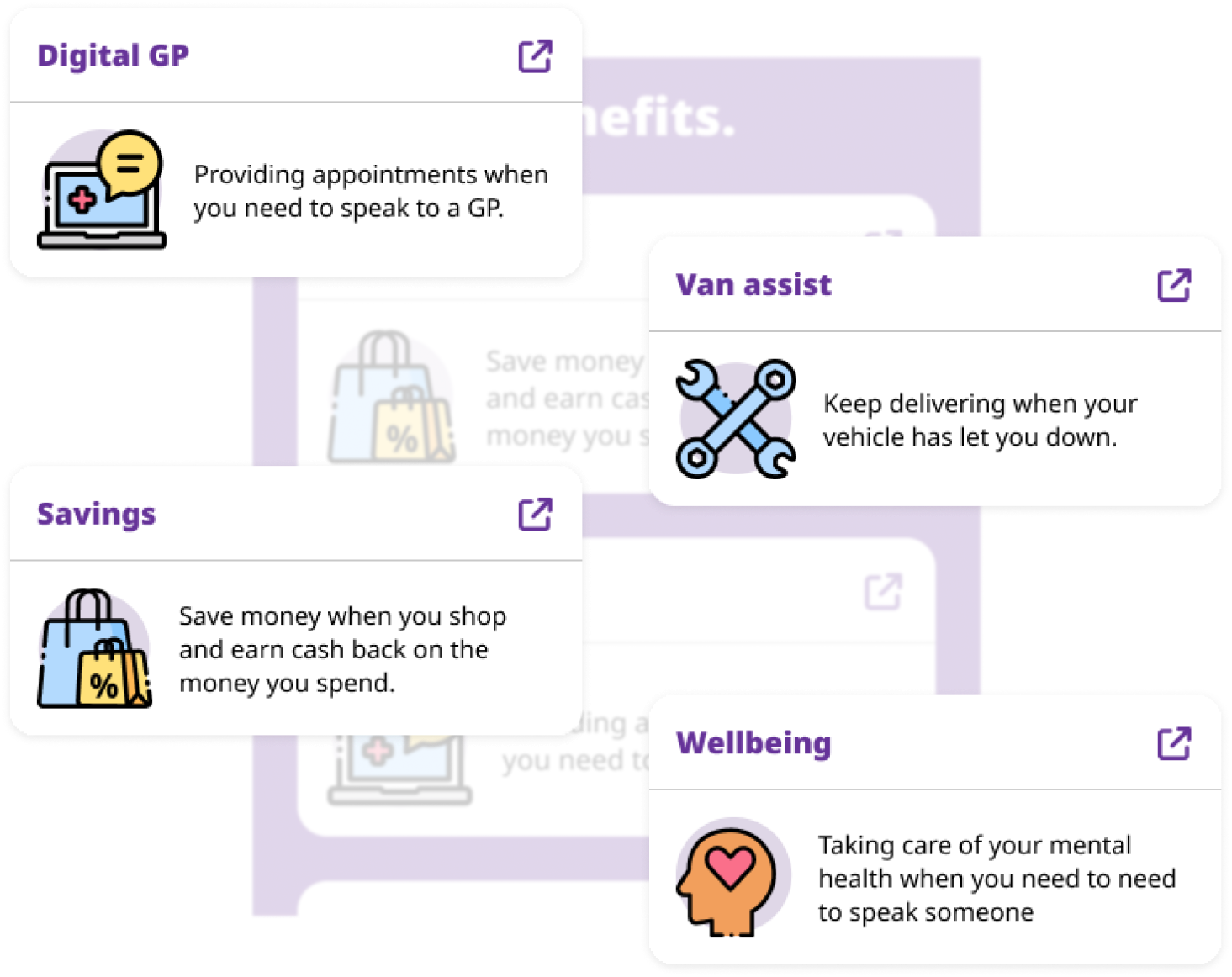

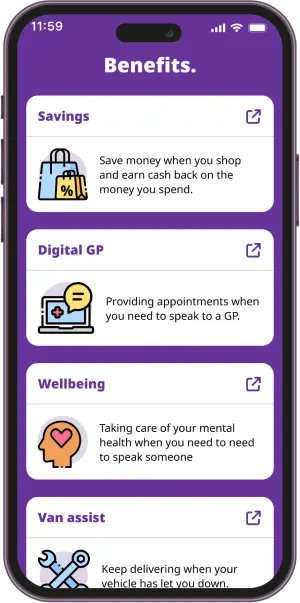

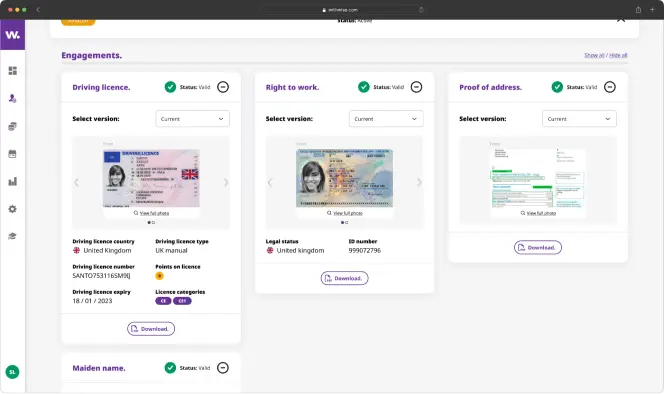

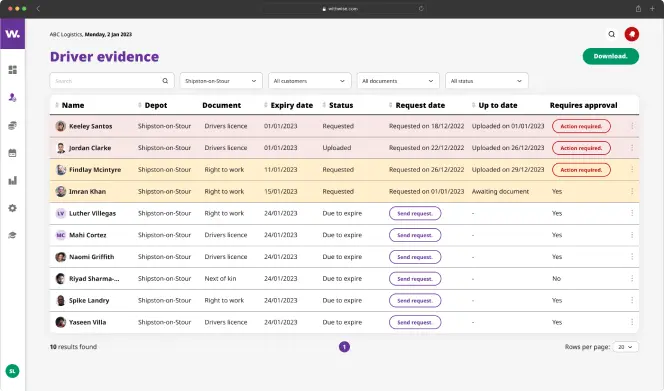

Improving self-employed driver retention rates just got much easier with the Wise Platform. The all-in-one last-mile driver management platform has already helped over 250 UK delivery companies boost driver retention through accountancy services and driver perks.

At Wise, we work with a specialist accountancy company that is an expert in the self-employment sector and supports thousands of self-employed delivery drivers annually. They are the go-to accountancy company for self-employed drivers who are looking for a trouble-free, cost-efficient solution to maximise their take-home pay.

When working with Wise, self-employed drivers have the option to choose between two products:

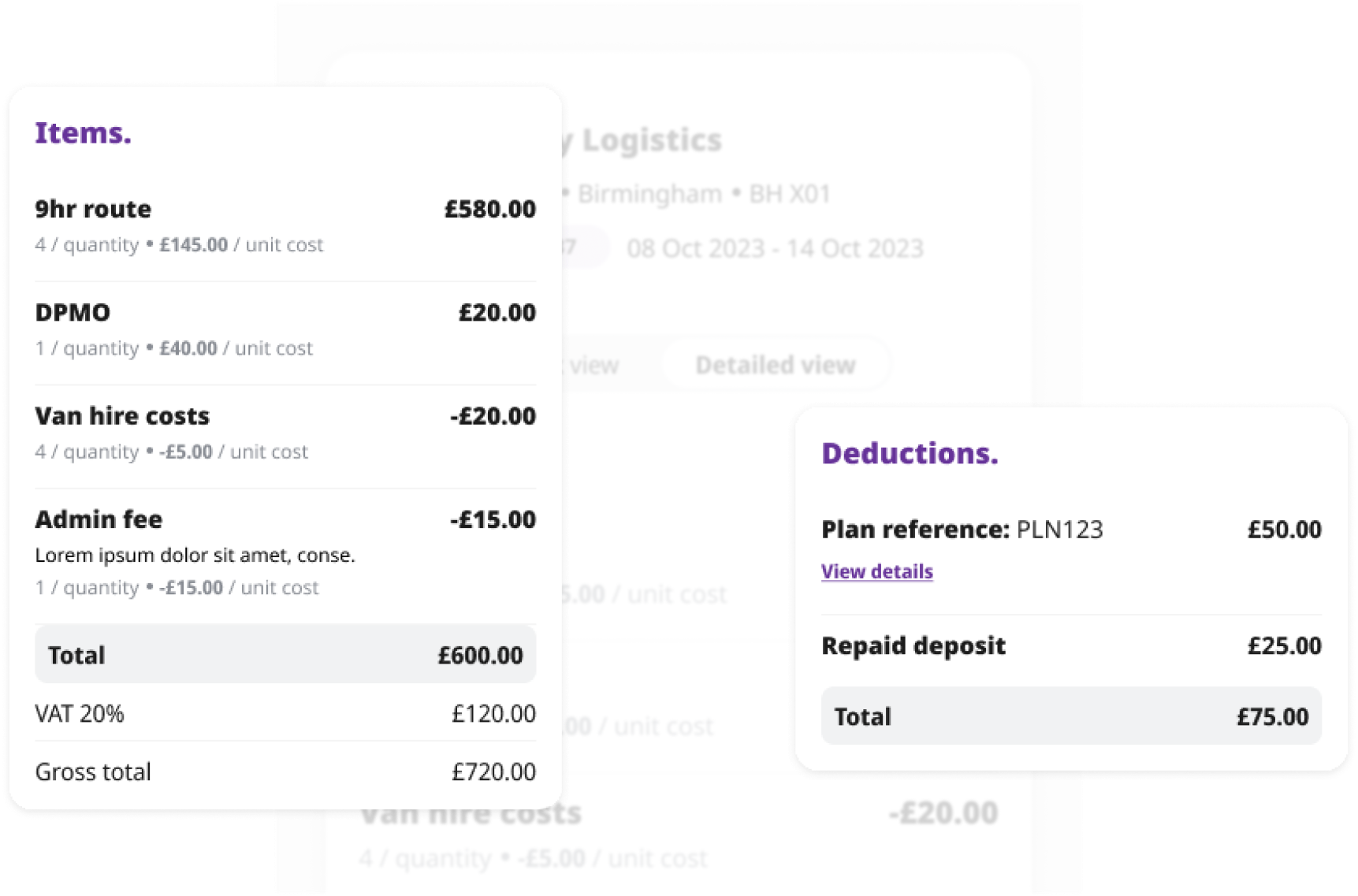

Wise Invoicing – A service that raises self-employed drivers’ invoices each week on their behalf

Wise Invoicing & Securitax Accountancy Bundle – A service that manages self-employed drivers’ invoicing and accountancy on their behalf

Through the Wise Invoicing & Securitax Accountancy Bundle, eligible self-employed drivers are registered for the Flat Rate VAT scheme. With the Flat Rate VAT scheme, businesses keep the difference between the amount of VAT paid to HMRC (HM Revenue & Customs) and the amount of VAT paid by customers. On average, self-employed drivers take home an additional £1,500 per year with this initiative.

Work with Wise

The Wise Platform is a free driver onboarding and management software that courier businesses all across the UK are benefiting from to boost their driver’s take-home pay. Don’t miss out; speak to one of our product experts today.