Table of Contents

- What is IR35?

- Why does IR35 exist?

- Who is responsible for IR35?

- Who does IR35 apply to?

- What does being inside IR35 mean?

- What does being outside IR35 mean?

- What is the conflict between being registered as a limited company but seen as an employee for tax purposes and from an employment status perspective?

- How is status determined

- Supervision, direction and control

- Right to substitute

- Mutuality of obligation

- Is IR35 still relevant in 2025?

- How can Wise help you manage IR35?

Key Takeaways

- IR35, or the off-payroll working rules, is a tax legislation designed to prevent individuals from avoiding tax by operating through a limited company while working like an employee.

- Since 2021, private sector businesses (rather than contractors) are responsible for assessing IR35 status, making it essential for companies to correctly classify their workforce.

- Being inside IR35 means paying taxes like an employee, while being outside IR35 allows contractors to benefit from tax efficiencies as self-employed individuals.

- HMRC assesses employment status using tests such as control over work, right to substitution, and mutuality of obligation to determine if a contractor is genuinely self-employed.

This guide will help you to be more informed on the basics of IR35 so you can understand whether the off-payroll working rules apply to you and more importantly, determine the actions you need to take.

Whether you’re self-employed or work at a company that engages self-employed drivers, you’ll have heard about IR35.

As is the case with many tax-related issues, there is a lot of confusion and fear around this legislation, so our in-house compliance team have come together to produce this handy guide to help you get to grips with IR35, work out whether it affects you directly and offer a solution to all your compliance needs.

What is IR35?

IR35 also known as the off-payroll working rules, is a tax legislation introduced in 2000 which aims to prevent individuals from avoiding tax by working through a private limited company rather than being on a payroll.

IR35 targets “disguised employees”, who work as employees but present themselves as limited companies for tax avoidance purposes.

Why does IR35 exist?

IR35 was introduced to prevent tax avoidance by individuals who provide services through a limited company but work in a manner similar to employees. Before IR35, some businesses and workers used this structure to reduce tax liabilities, allowing individuals to pay lower rates of tax and National Insurance compared to standard employees. IR35 ensures that those who work like employees pay the appropriate tax and National Insurance contributions, preventing unfair tax advantages

Who is responsible for determining the status of contractors?

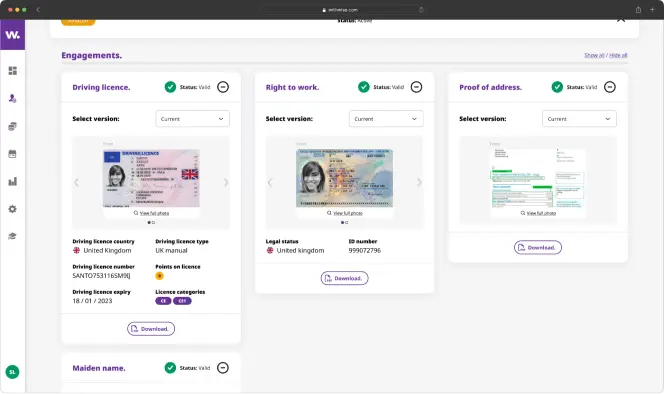

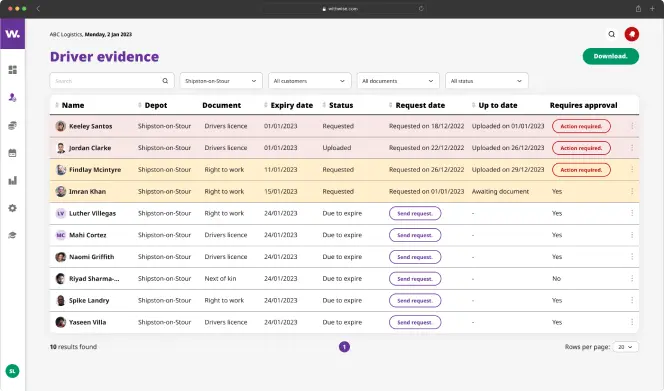

Originally, contractors were responsible for assessing whether IR35 applied to them, but since 2017 in the public sector and 2021 in the private sector, the responsibility shifted to the end-user company, which must determine the contractor’s tax status. Therefore, it is fundamental that companies respect and are well aware of the status of their workforce and each engaged contractor.

Who does IR35 apply to?

IR35 applies to medium and large businesses that meet at least two of the following conditions:

- Annual turnover over £10.2 million

- Balance sheet total over £5.1 million

- More than 50 employees

Small businesses are exempt from these changes. HMRC can audit a contractor’s tax status, considering factors like control, substitution, mutuality of obligation, financial risk, and the type of contract to determine if IR35 applies.

Businesses must ensure compliance to avoid penalties, especially as more companies engage self-employed individuals.

What does being inside IR35 mean?

If you are assessed to be inside IR35, it means that for tax purposes, you are considered an employee rather than a genuinely self-employed contractor, even if you operate through a limited company. As a result, you are required to pay income tax and National Insurance contributions similar to a PAYE employee

What does being outside IR35 mean?

If you are outside IR35, you are considered genuinely self-employed for tax purposes and can operate through a limited company, benefiting from the associated tax efficiencies. This also means that your working arrangements align with your status as an independent contractor, reflecting the reality of how you provide your services.

What is the conflict between being registered as a limited company but seen as an employee for tax purposes and from an employment status perspective?

You would be in violation of IR35 rules if you operate through a limited company but your working relationship with the client (or employer) mirrors that of an employee.

This typically happens when a contractor:

- Has an obligation to provide a personal service (i.e., they cannot send a substitute to do the work).

- Is required to provide a minimum amount of work.

- Is heavily controlled and supervised by the client.

- Does not have the right to substitution.

- Cannot disengage immediately without notice or reason.

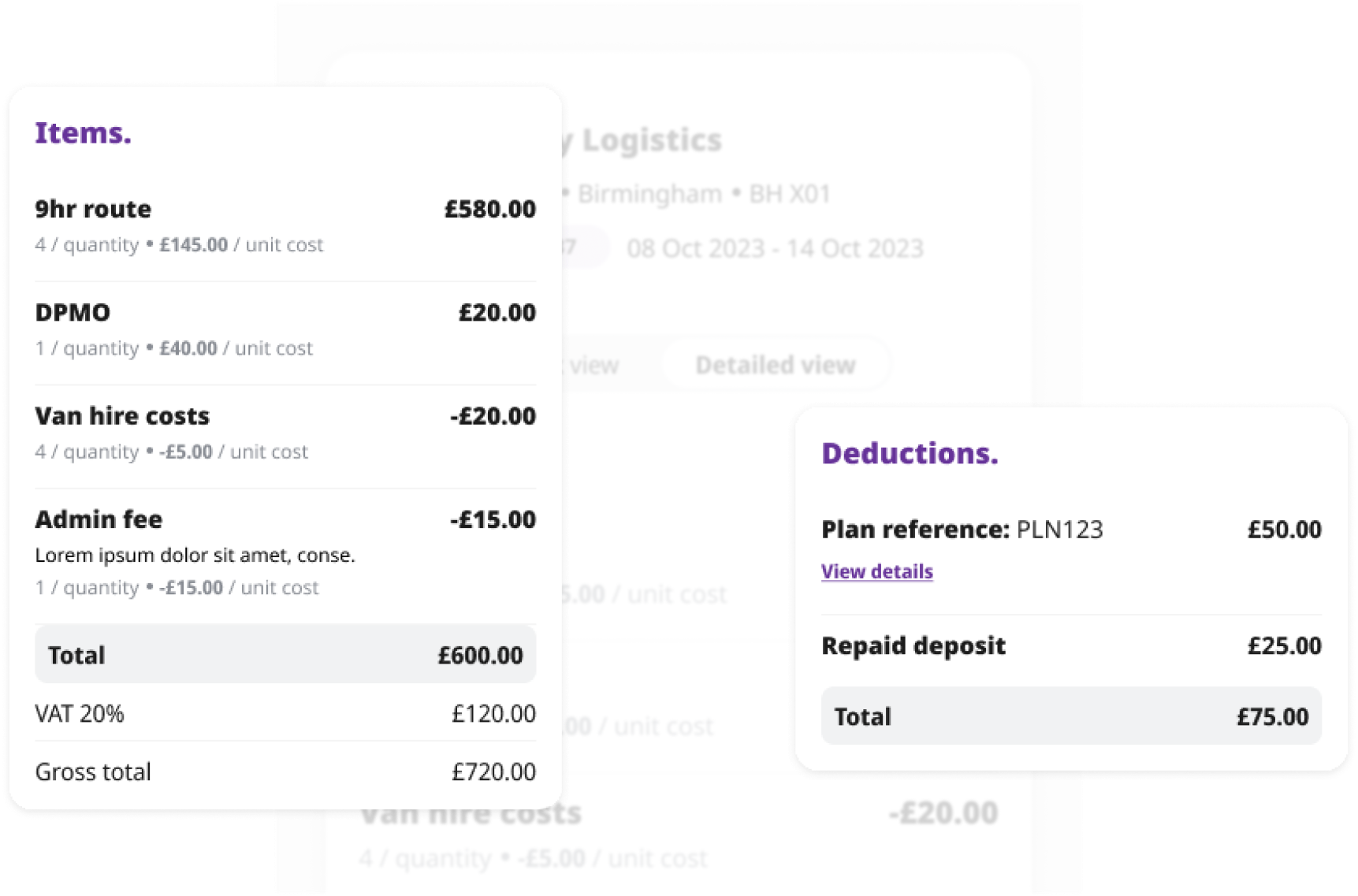

- Little to no financial risk (i.e., they do not operate as a true business with responsibility for its own success or failure).

Imagine this: You are working as a full-time employee for a company. One day, you decide to leave and set up a limited company, claiming to be self-employed. However, you continue working for the same company under the exact same conditions – your tasks, expectations, and obligations remain unchanged. The only difference is how you are paid and taxed. This is known as ‘disguised employment’ and is what IR35 is designed to prevent.

How is status determined?

There are three main tests HMRC uses to determine whether someone should be classed as self-employed and therefore falls inside or outside of IR35.

Supervision, direction and control:

This test assesses how much control the work provider (the company) has over how the work is completed and performed. For a contractor (e.g., a driver) to be considered genuinely self-employed, they should not be subject to significant control, supervision, or monitoring. Instead, they should have the discretion to determine how they perform their services in the most effective and efficient way.

Right to Substitute:

This test considers whether or not the individual could bring someone else in to complete their services on their behalf. The inability to utilise a substitute implies employment, rather than self-employment.

Mutuality of Obligation:

For an individual to be genuinely self-employed, there must be no mutuality of obligation. This means that a self-employed contractor should not be required to accept work, nor should they be obligated to provide a personal service. Likewise, the company hiring them is not obliged to offer work or guarantee a minimum amount of work.

Additionally, self-employed contractors are not entitled to employment rights such as holiday pay or sick pay, as they operate independently rather than as employees.

Is IR35 still relevant in 2025?

After the changes go live in April 2023, IR35 will still very much be applicable. The core principles of IR35 remain unchanged; what has undergone alteration is the process of establishing employment status, which now shifts from clients back to the contractor or their limited company.

Yes, IR35 remains relevant in 2025. The legislation continues to govern the tax status of individuals providing services through intermediaries. Its primary aim is to ensure that individuals working in a manner similar to employees pay the appropriate taxes.

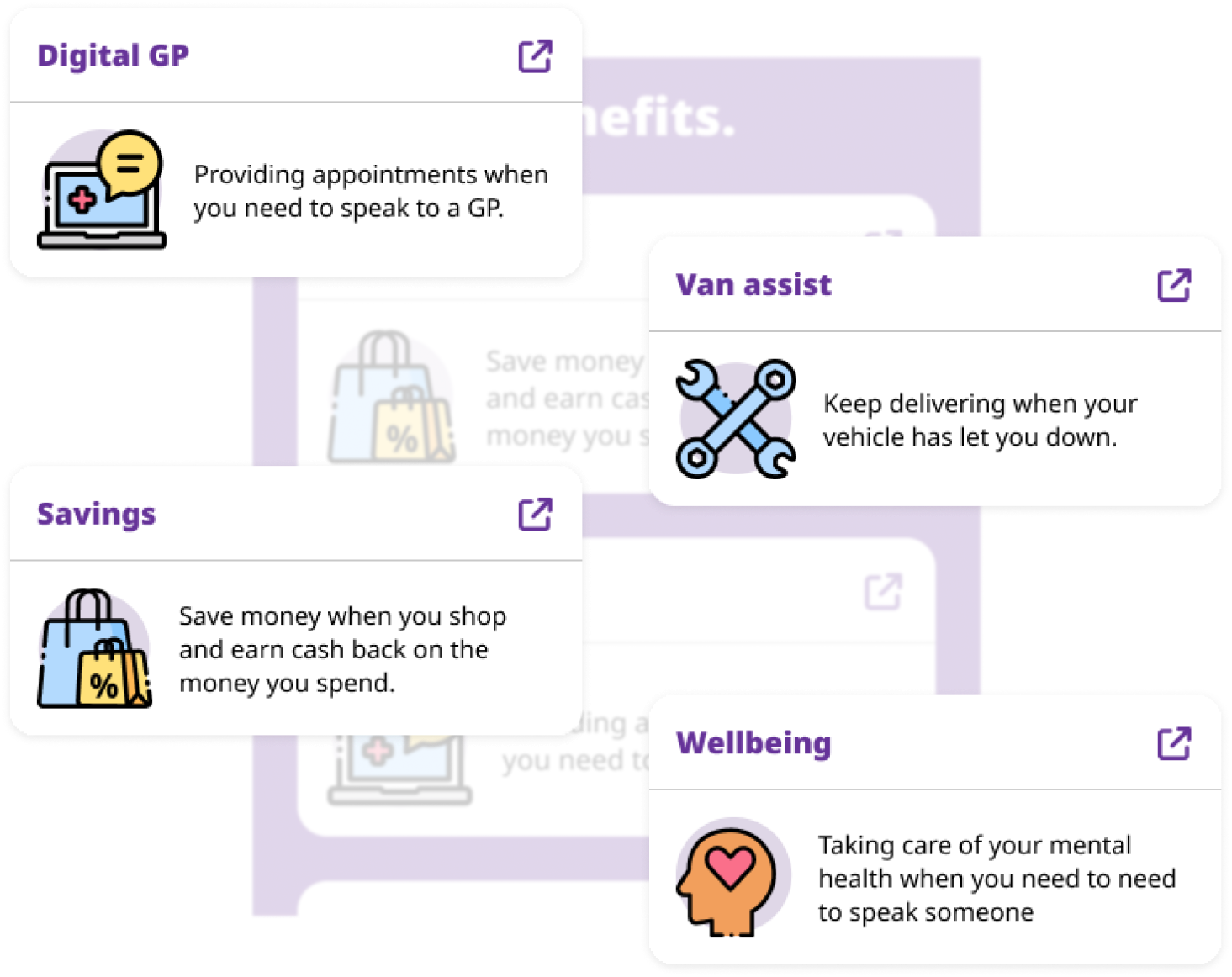

How can Wise help you manage IR35?

Wise can help by providing a clear explanation of IR35, outlining the potential risks of non-compliance.

We provide expert guidance to companies within the IR35 threshold, helping them navigate the legislation and avoid penalties while maintaining compliance with tax and employment laws.