If you’re new to working with Wise, or have just stumbled upon us. You may have heard the name ‘Securitax’ mentioned a fair bit in relation to some of our products. So, who exactly are Securitax?

Securitax are accountancy experts who specialise in the self-employment sector, supporting thousands of subcontractors and sole traders every year. They are the go-to accountancy company for self-employed subcontractors who are looking for a trouble-free, cost-efficient solution to maximise their take-home pay.

What services do Securitax provide?

- Submit tax-returns on your behalf

- Calculate all allowable expenses

- Registering you for any tax incentives

- Registering you for self-employment

- Maximise your take-home pay

How do Wise and Securitax work together?

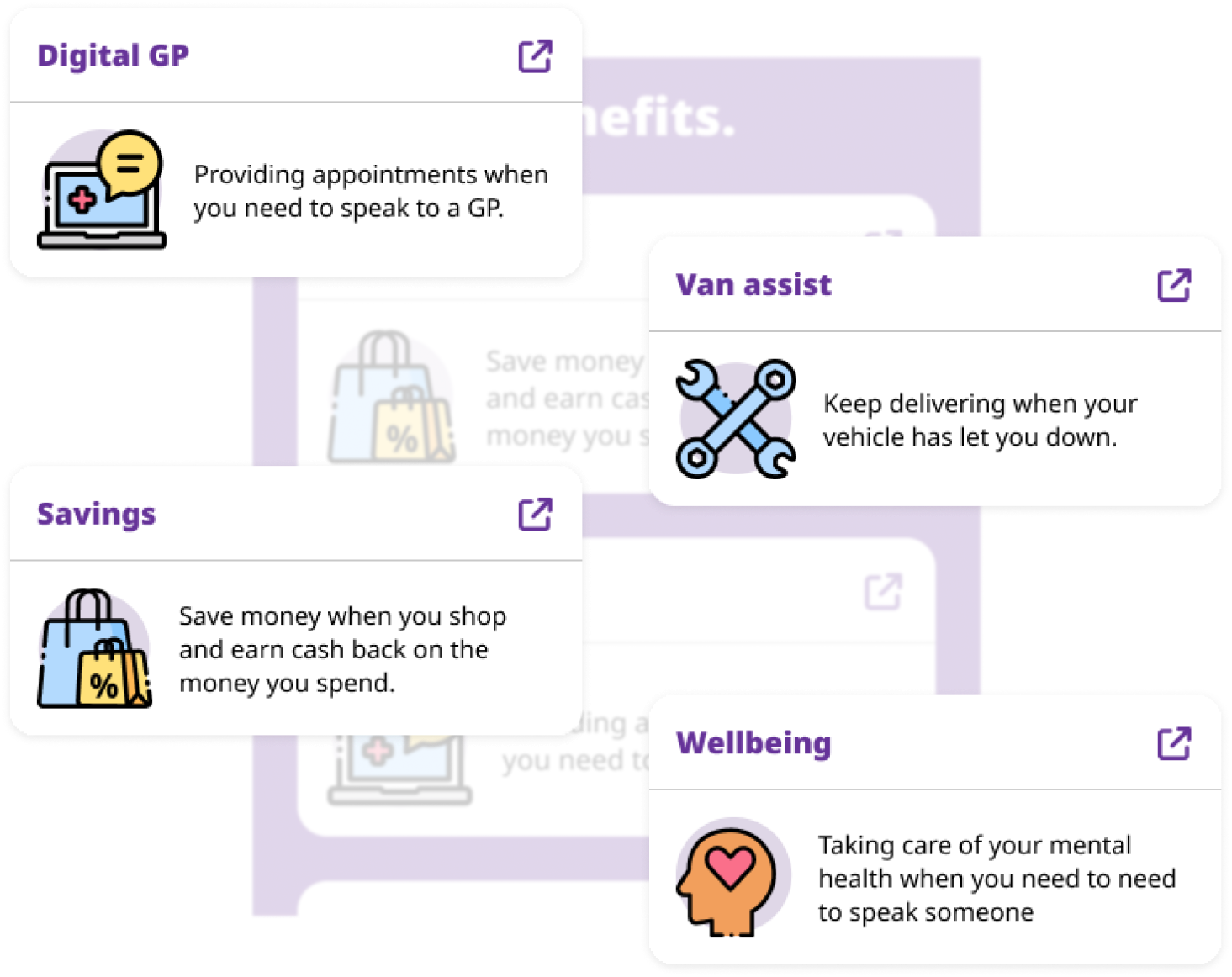

If you’re a self-employed subcontractor, by choosing certain Wise products you’ll automatically benefit from this expert accountancy support from Securitax, for instance:

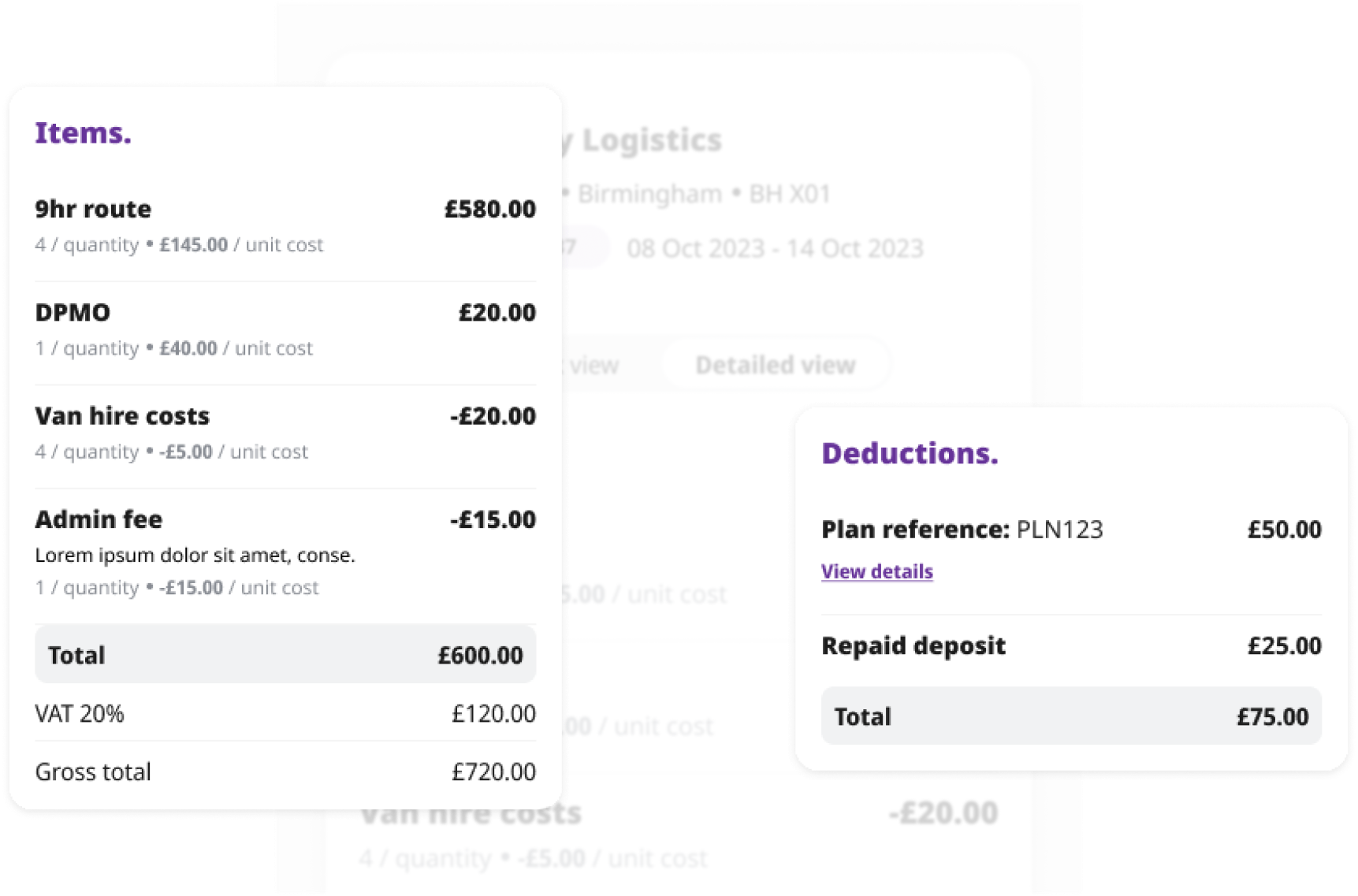

- Wise Invoicing

With this product, Secuitax raises all of your invoices on your behalf and administers your weekly payments for £12.50 per week.

- Wise Invoicing + Securitax Accountancy

Securitax not only raises all of your invoices and administers your weekly payments, but they also:

- Register you with HMRC and request your UTR number

- Register you for the flat-rate VAT scheme, if you are eligible

- Submit your quarterly and end-of-year tax returns

- Complete all of your VAT paperwork

- Offer advice and support around expenses

All this is done for £15 per week, and your take-home pay can be boosted by as much as £30 per week at the same time!

How can you find out more about these products?

If you’re a business owner and are interested in finding out more about Wise and how its platform can help you save time, money and stress, you can book a 15-minute system demo here.