Are you considering changing your career and considering setting up as either a sole trader or a limited company? In this article, we will discuss the pros and cons of both types of employment, helping you to make the most informed choice for your business.

Every business, no matter the size, will need a legal structure and so understanding the differences between each type is very important.

What is a sole trader?

A sole trader is a self-employed individual who is the sole owner of a business. It’s the simplest business form and the most popular, particularly amongst tradespeople.

Sole trader pros

- Virtually no paperwork is required other than the end of year self-assessment tax return

- You won’t be able to be found on Companies House, resulting in more privacy

- Easy to set-up

Sole trader cons

- Unlimited liability, meaning there is no legal difference between yourself and your business – so if your business gets into debt, you are liable to cover this personally

- You could potentially lose all of your personal assets if things went badly and the business got into debt

- Banks and investment companies usually prefer limited companies, it is typically quite hard for sole traders to raise money immediately, limiting possible expansion opportunities

- Tax rates for sole traders can be quite hefty compared to limited companies

What is a limited company?

A limited company has its own legal identity, that is separate from its owners (shareholders) and its managers (directors).

Limited company pros

- A limited company is legally separate from its business owners(s), who have limited liability – if any legal action was to be taken it would be against the business and not the shareholders

- Any personal assets aren’t at risk to be lost – you only have the option to lose what you put in the company

- Once your company name has been registered, no one else can use it – unlike sole traders

- Rather than paying income tax, corporation tax is paid on profits which allows you to be more tax-efficient

- There is a wide range of allowances and tax-deductible costs that limited companies can claim against profits

Limited company cons

- Higher responsibility, known as the director’s fiduciary responsibilities, outlines what is expected of a limited company legally

- Extra paperwork is involved to cover these fiduciary responsibilities

- Detailed information about your business can be found on Companies House such as directors’ details and company earnings, this level of transparency may not appeal to all

- Incorporation fee, when you set up as a limited company

It is important to really consider the pros and cons of both types of employment before you make your move into self-employment, in order to make sure you are choosing the type that’s right for you.

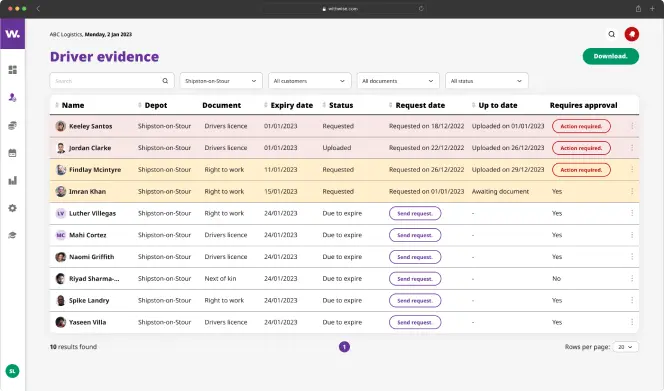

At Wise, we provide software to both main contractors and self-employed individuals. Not only do we help to streamline onboarding and payments (making it easier and quicker than ever before), we also review your contracts for FREE, ensuring compliance with employment status guidelines and HMRC protection.

book a 15-minute call with us where we can explain everything to you and answer any questions you might have.