Have you ever found yourself a little confused when dealing with your taxes? In this article, we will take a brief look into what HMRC actually is and how this impacts all areas of employment.

- What does HMRC stand for?

HMRC stands for Her Majesty’s Revenue and Customs. Revenue signifies income and Customs represents tax. HMRC is a government department that has the responsibility for collecting, paying, managing and implementing taxes, with people often using phrases such as ‘the tax man’ or ‘the tax office’ when referencing HMRC.

- What did HMRC use to be called?

Over a decade ago, HMRC used to be split up into two separate departments called the ‘Inland Revenue’ and ‘Her Majesty’s Customs and Excise’ which joined together in 2005 to create HM Revenue and Customs.

- What does HMRC do?

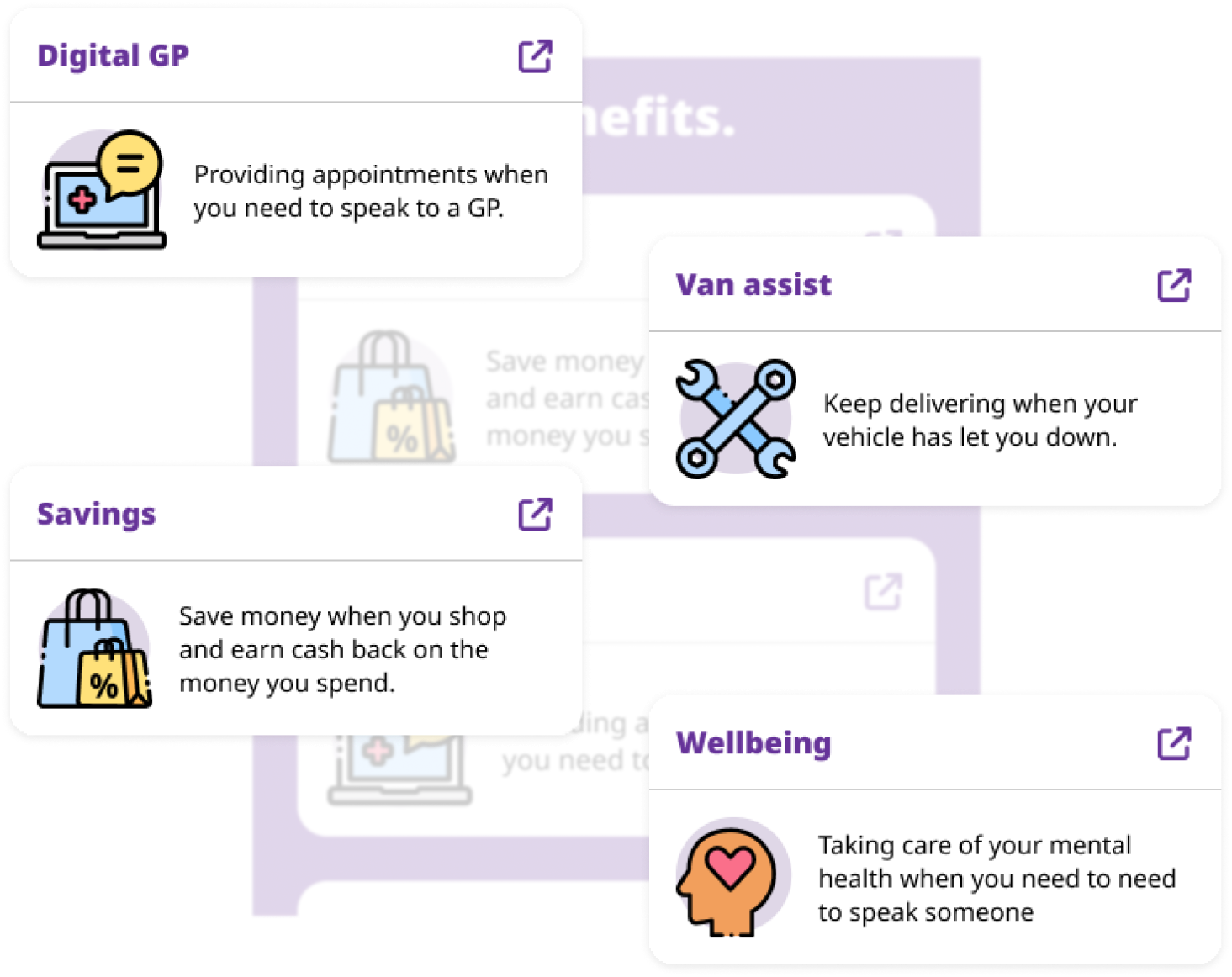

HMRC has a range of varied responsibilities that will affect both your working finances and monthly income, regardless of your type of employment.

HMRC has the following responsibilities:

- Enforcing minimum wage

- Collecting employee National Insurance Contributions (NICs) from taxpayers (NIC’s are not defined as tax as they are explicitly required to pay for unemployment, sickness, disability benefits and pensions)

- Collecting income tax

- What does HMRC have the authority to collect?

The tax system in the UK can appear particularly complex, with various different types of tax being controlled by a multitude of intricate regulations. HMRC has the authority to collect the below:

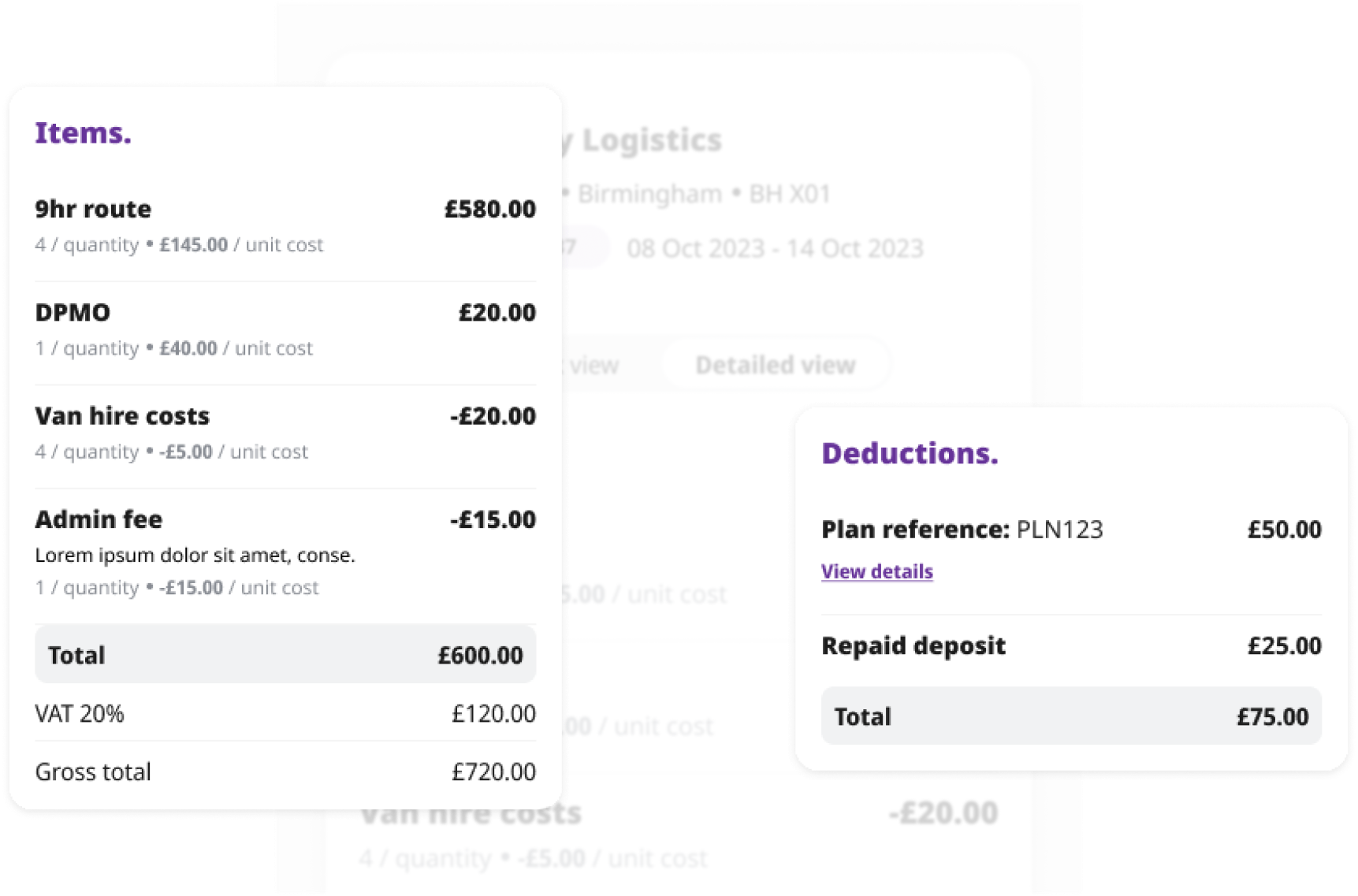

- VAT – this signifies Value Added Tax and is the tax that sellers pay on most services and goods. In the UK, the standard rate of this tax is 20% of the cost of an item and this is added to the price for consumers. If you’re a self-employed subcontractor, Wise can help you maximise your income.

- Income Tax – This is the tax placed on the money you earn in the UK from your wages/salary, rental income and pensions. Income tax is designed to pay for services we get from the government such as education and transport.

- Corporation Tax – Limited Companies and some other organisations are required to pay corporation tax on any profits they make.

Wise partners with a specialist team of accountants who can advise you on your tax situation and are experts in all things HMRC and tax law.

If you’re a business and would like to find out more about how Wise can help you save time, money and stress, book a FREE demo here.