Regardless of what industry your business operates in, compliance should be front of mind when making decisions, particularly when it involves your workforce or tax.

Bringing in processes and outside expertise to help manage the compliance of your business can seem like a lot of unnecessary effort, but it can save your company from a series of long-term issues.

What is compliance?

The definition of compliance is “the action of complying with a command,” or “the state of meeting rules or standards.”. Compliance, in business terms, is the process of ensuring that your business adheres with all applicable laws, rules, standards and ethical principles that apply to your industry.

Typically, in the last-mile delivery sector, compliance relates to how a business manages its self employed drivers in terms of employment status, tax, contracts, working practices and invoicing.

The benefits of compliance for your business

- Reduce legal problems – The most obvious benefit of keeping on top of compliance is that it vastly reduces the risk of fines or more severe penalties in the future.

- Improves operational efficiency and safety – Many business rules and regulations can effectively help you more than harm you. For example, following safety and security procedures help minimise any injuries, fires etc that could potentially hurt your profitability.

- Improve business reputation – By meeting legal requirements, it will improve your company’s reputation in the eyes of the public, as well as with your clients and stakeholders.

- Customer trust – One of the most important factors in the success of a business is the trust built with customers. A record of strong, consistent compliance will show that you are running a trustworthy business.

- Better subcontractor retention – By creating a professional environment where compliance policies are not only in place, but enforced as such, subcontractors know they’re dealing with an efficient and well-managed business.

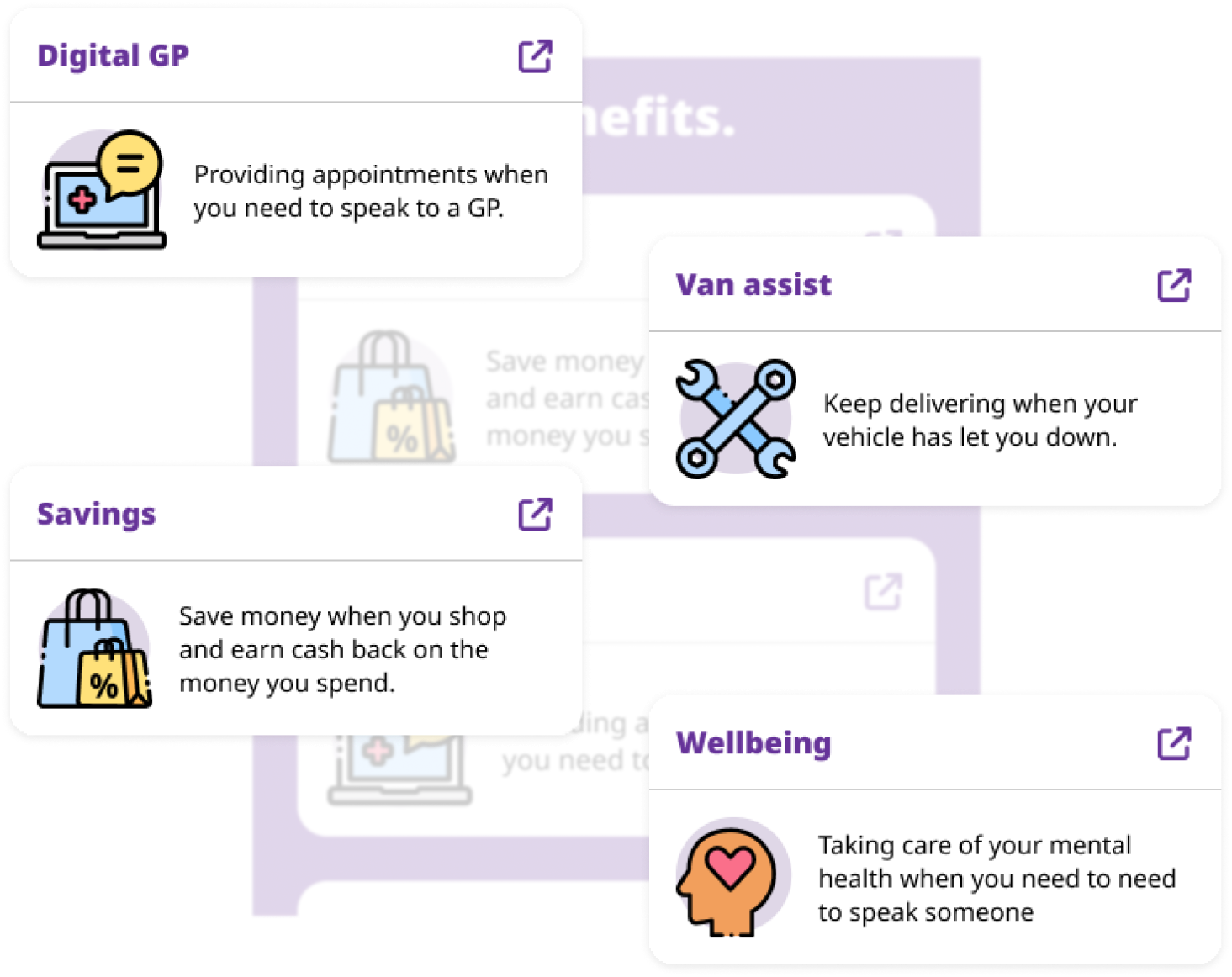

How can Wise help?

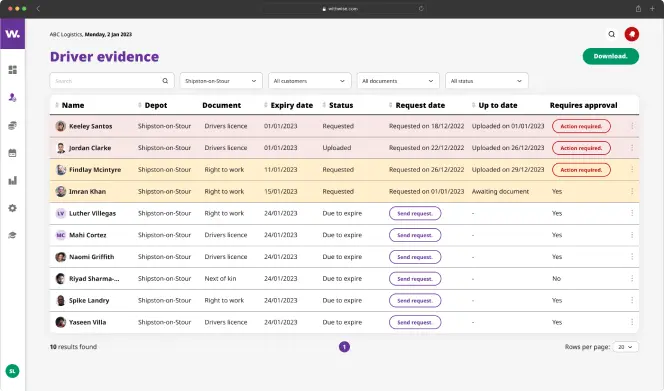

Wise has a specialist compliance team that can make sure your business is not only fully protected, but also prepared for any potential audits by HMRC. Wise’s team of industry experts provide regulatory advice to make sure your business is managing its self-employed workforce correctly. This consultation can involve:

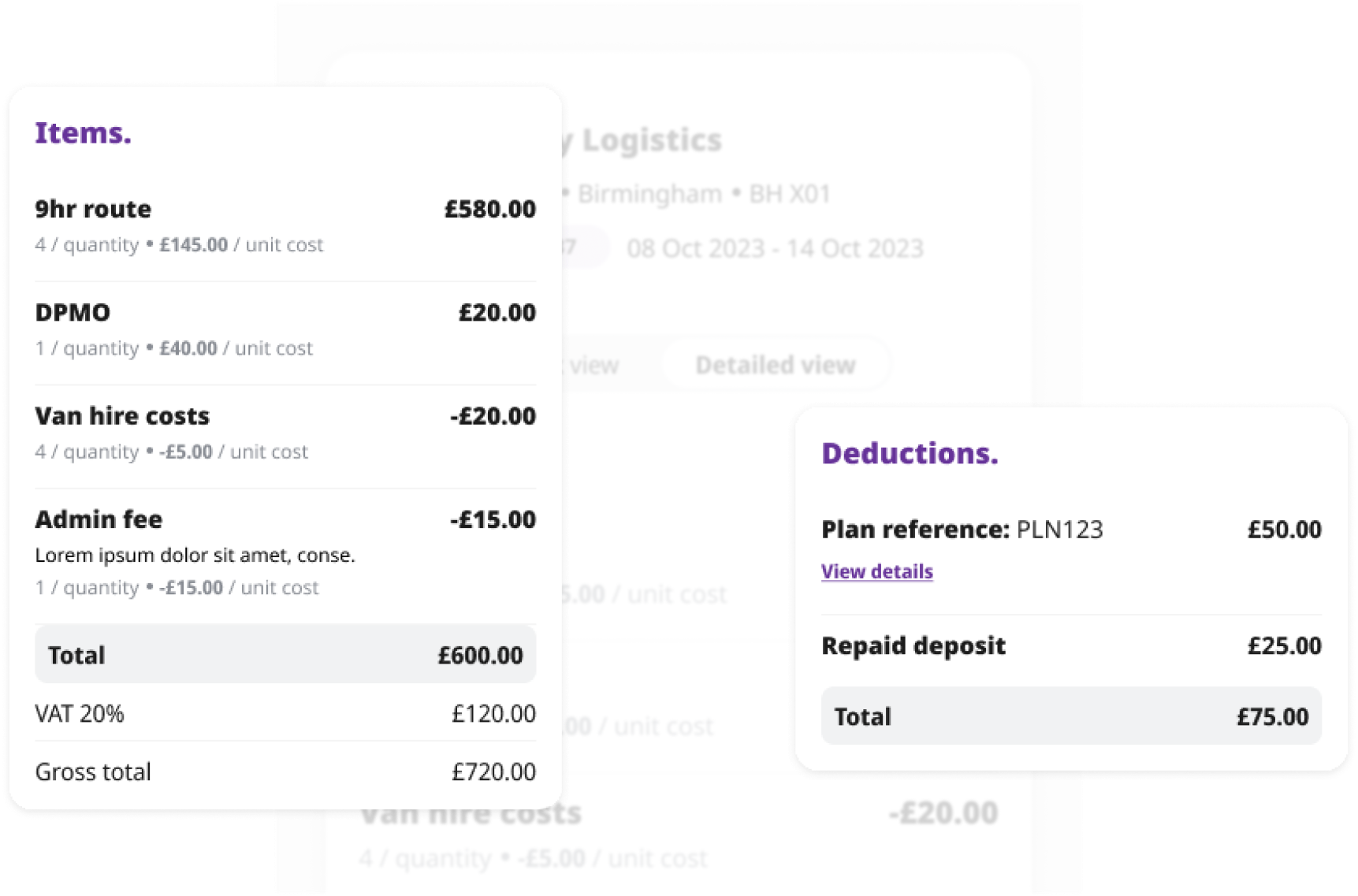

- Samples of invoices and remittance advice

- Details of health & safety and security policies plus any other agreements

- Details of working practices

- Copy of VAT certificate

The Wise compliance team will then review all the information provided and create an advisory pack if changes are needed. If you’re interested in using the Wise system to protect your business’s compliance, book a demo with one of our experts here and request a FREE contract review!