If you’re seeing this page, it may be because you need help either finding or submitting your UTR number.

Why is your UTR number important?

All self-employed individuals will need their UTR (Unique Tax Reference) number to file their tax return at the end of the tax year. Many clients may also require you to submit your UTR number when providing your service, to show that you are a compliant self-employed person.

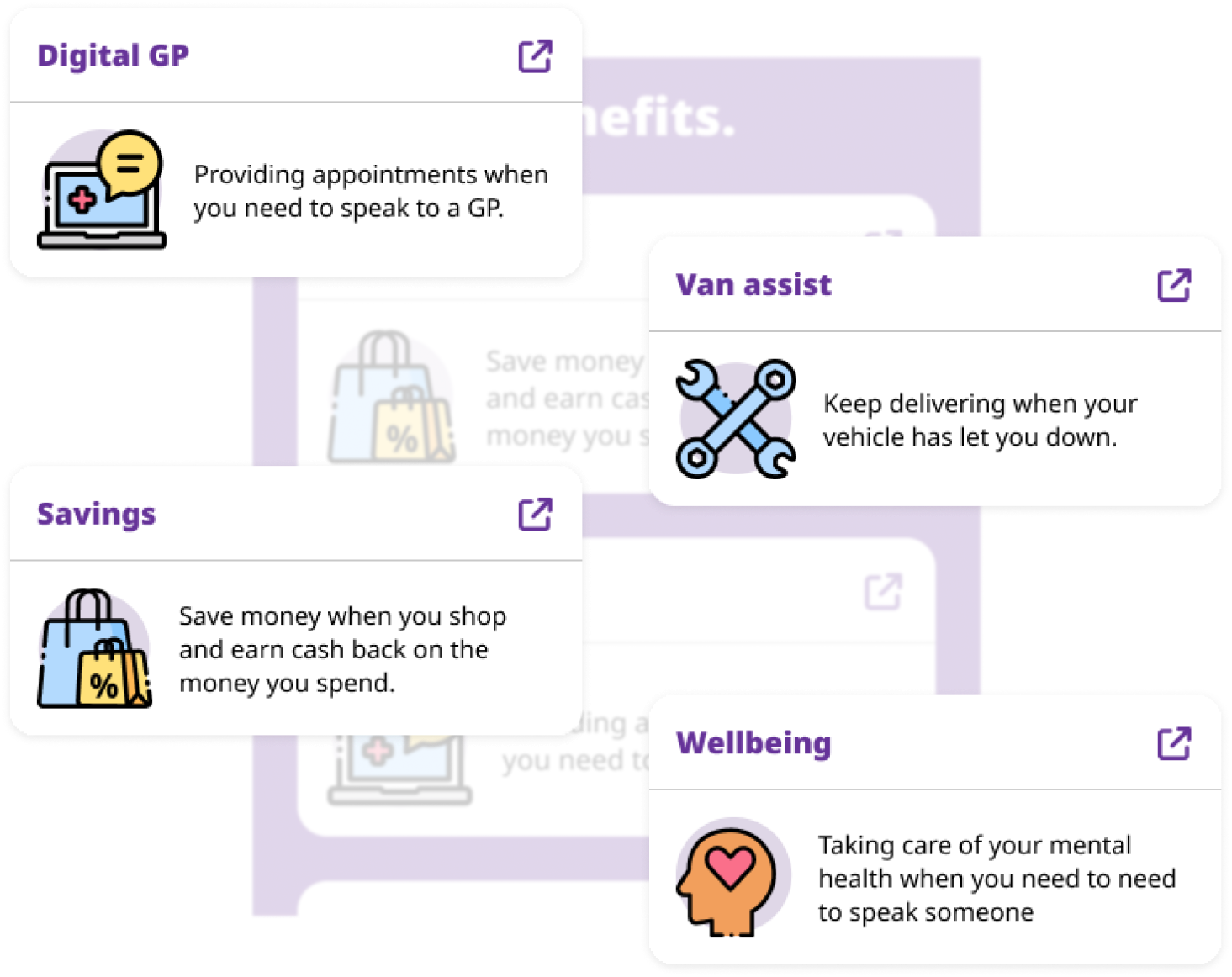

Wise & Securitax Bundle

If you have selected the Wise & Securitax Bundle, Securitax will need your UTR number so that they can complete tax work on your behalf. This UTR number helps us to validate that you are a compliant driver – without this, Securitax can’t provide you with accountancy services and your client may also choose to disengage with you.

Wise Invoicing

If you selected Wise Invoicing, you will still need to provide your UTR number so that Wise can verify you as a compliant self-employed driver to your clients. Many clients will insist you provide a UTR number when engaging your service and may even choose to refrain from engaging your service if you fail to prove that you are set up correctly with HMRC.

How to find your UTR number

If you selected the Wise & Securitax Bundle and you are not already registered as self-employed, Securitax will have applied for this on your behalf and it should arrive to you via post within 12 weeks of being registered with HMRC.

If you did not receive or find this letter, call HMRC on 0300 200 3310 and ask them to let you know what that number is by post or over the phone. Occasionally, they will insist on posting this out for security reasons.

How to submit your UTR number

To submit your UTR number, simply log in to the Wise app, tap on your profile picture to open up your account details, and select ‘VAT details’. Here, you should find the field called Unique Tax Reference (UTR).

If you have any questions or issues, please contact our help desk on 0127 7424 423.