Table of Contents

- Key Takeaways

- What is Labour Proposing?

- How Will These Changes Impact Your Business?

- Timeline for Reforms

- Steps to Prepare Your Business

- Why Are These Changes Happening?

- FAQs

- Wise can help you!

Key Takeaways

- Labour’s proposed reforms include replacing the current three-tier employment status system with a two-tier framework: worker and self-employed.

- Businesses that rely on self-employed contractors may need to reassess their contracts and working arrangements to avoid misclassification risks.

- Stricter enforcement of minimum wage and sick pay rules could increase compliance costs and administrative burdens for companies using subcontractors.

- The changes will be implemented gradually, with most reforms expected to take effect by 2026.

What is Labour Proposing?

Labour’s Employment Rights Bill, introduced in October 2024, outlines significant changes to employment law that will affect how businesses engage with self-employed subcontractors. These changes aim to create a fairer balance between employers and workers while addressing gaps in the current system.

Single Employment Status

Labour proposes simplifying the current three-tier employment status system (employee, worker, and self-employed) into a two-tier framework:

- Worker: Combines employees and workers, granting broader rights such as holiday pay and unfair dismissal protection.

- Self-Employed: Retains autonomy but will face stricter classification rules.

For businesses, this could mean that some contractors currently classified as self-employed might be reclassified as workers. This shift could result in added obligations, such as providing holiday pay and adhering to unfair dismissal rules.

Zero-Hour Contracts Reform

The proposed ban on exploitative zero-hour contracts will require businesses to provide predictable hours for workers. Companies may need to adjust their practices to ensure compliance for contractors working on flexible agreements.

Statutory Sick Pay

Labour plans to remove the lower earnings limit for statutory sick pay, making it accessible to more workers. Businesses that engage contractors may need to evaluate whether their engagements could be considered employment relationships under these new rules.

How Will These Changes Impact Your Business?

Labour’s reforms aim to redefine working relationships, which could have significant consequences for businesses that rely on self-employed subcontractors.

Potential Challenges:

- Reclassification Risks:

Under the new two-tier system, contractors classified as self-employed could be reclassified as workers, which would bring additional obligations such as sick pay, holiday pay, and unfair dismissal rights. - Increased Costs:

Stricter enforcement of minimum wage, statutory sick pay, and holiday entitlement rules could increase compliance costs for businesses that engage contractors. - Contractual Adjustments:

Contracts with subcontractors may need to be reviewed and updated to ensure they align with the new framework and reduce the risk of misclassification. - Administrative Burdens:

Businesses may face additional scrutiny and reporting requirements, particularly around pay practices and employment status determinations.

Opportunities:

- Clearer Guidelines:

A simplified two-tier system may give businesses more straightforward rules for determining employment status and obligations. - Improved Contractor Relationships:

Businesses can build stronger, more transparent relationships with subcontractors by ensuring fair treatment and compliance with new rules.

Timeline for Reforms

Labour has committed to consulting widely with businesses before implementing these reforms, giving companies time to prepare.

- Early December 2024: Initial consultations conclude, including employment status changes and statutory sick pay.

- Mid-2025: The Employment Rights Bill is expected to be passed into law.

- 2025–2026: Supporting regulations finalised.

- April 2026: Implementation date for reforms.

Steps to Prepare Your Business

Review Contracts with Subcontractors:

Assess whether your current contracts align with Labour’s proposed changes. Clearly outline the nature of the working relationship to reduce misclassification risks.

Review online content:

Review any recent online content, such as job adverts, and any relevant terminology that could negatively expose you to legal bodies, such as ‘no win no fee’ solicitors, Acas, or other organisations.

Audit Subcontractor Relationships:

Evaluate how your subcontractors are engaged and whether their work arrangements might fall under the new worker classification.

Seek Legal and Compliance Advice:

Consult legal or compliance professionals to prepare your business for the new rules and make sure you are respecting the employment status of your self-employed contractors. .

Plan for Additional Costs:

Factor potential increases in costs (e.g., sick pay, holiday pay, or compliance measures) into your budgeting and financial planning.

Stay Informed:

Stay current with Labour’s consultations and announcements to ensure you know when and how these changes will affect your business.

Why Are These Changes Happening?

Labour believes the current system creates confusion and unfairness, particularly for individuals working under ambiguous arrangements. Their reforms aim to reduce exploitation, provide clarity, and support economic growth by improving conditions for workers and contractors.

FAQS

Q: Will these changes affect all subcontractors?

Not necessarily. Genuine self-employed contractors who meet the criteria for independence under the new rules should retain their status. However, those in grey areas may face reclassification.

Q: What happens if a subcontractor is reclassified as a worker?

If a contractor is reclassified as a worker, your business must provide additional rights such as holiday pay, sick pay, and protection against unfair dismissal.

In addition to this, you would also be subject to paying compensation for the duration they have worked for you. This would include paying national insurance contributions, pension contributions where applicable, and any other additional payments if applicable.

Q: What do these changes mean for us?

Higher financial risk to businesses should their self-employed contractors be reclassified;

Employment tribunals will have greater enforcement powers which are likely to benefit employees/workers and subcontractors, rather than employers or businesses;

Increased publicity which creates awareness to subcontractors that may believe they should be employed. This can cause a surge of enquiries through bodies like Acas, or ‘no win no fee’ solicitors, costing companies £1000’s to defend.

Q: When will these changes come into effect?

Following consultations and regulatory updates, most reforms are expected to take effect by April 2026.

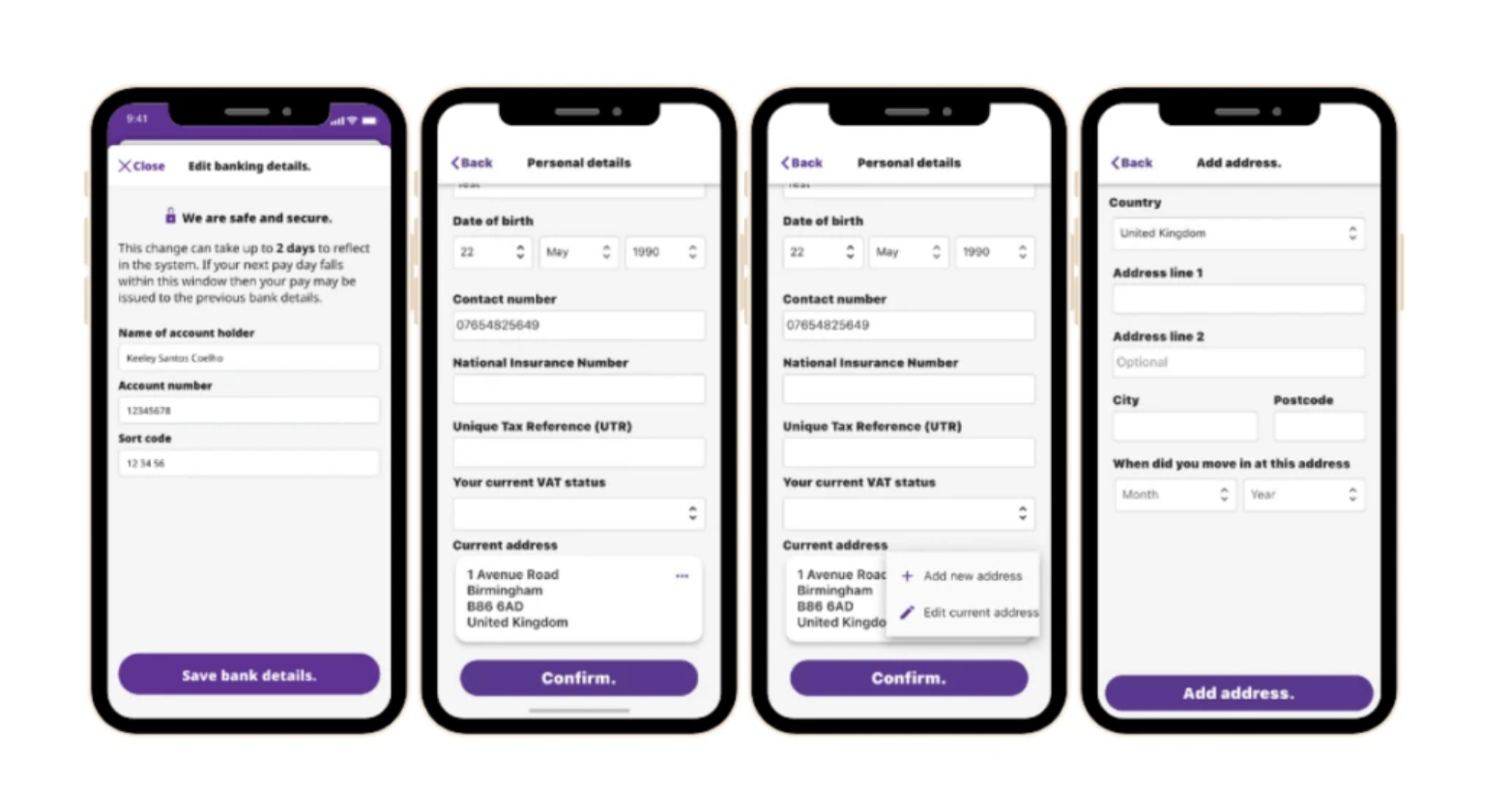

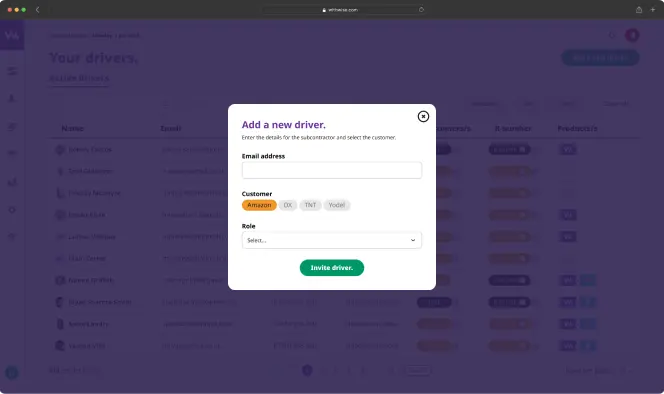

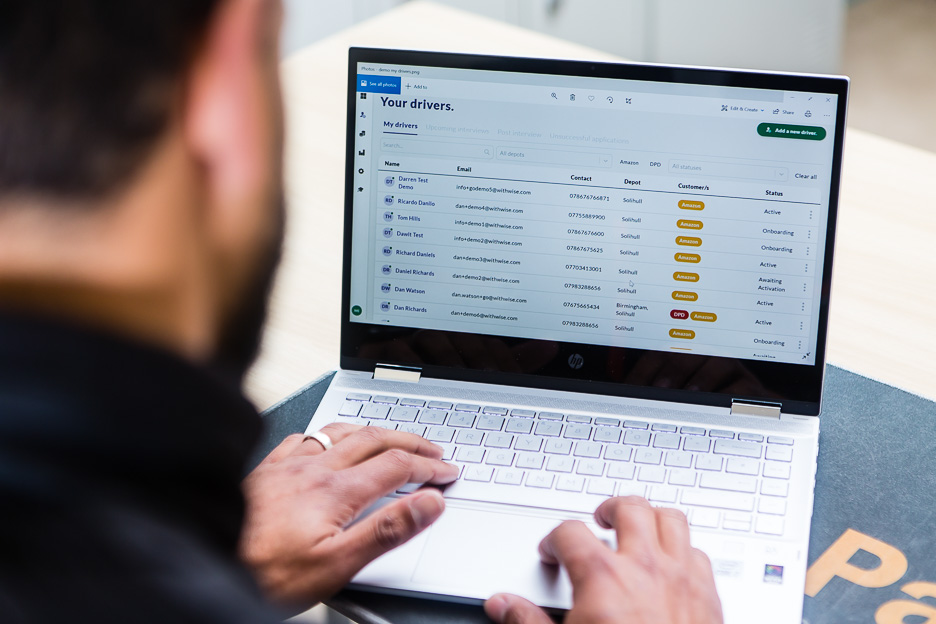

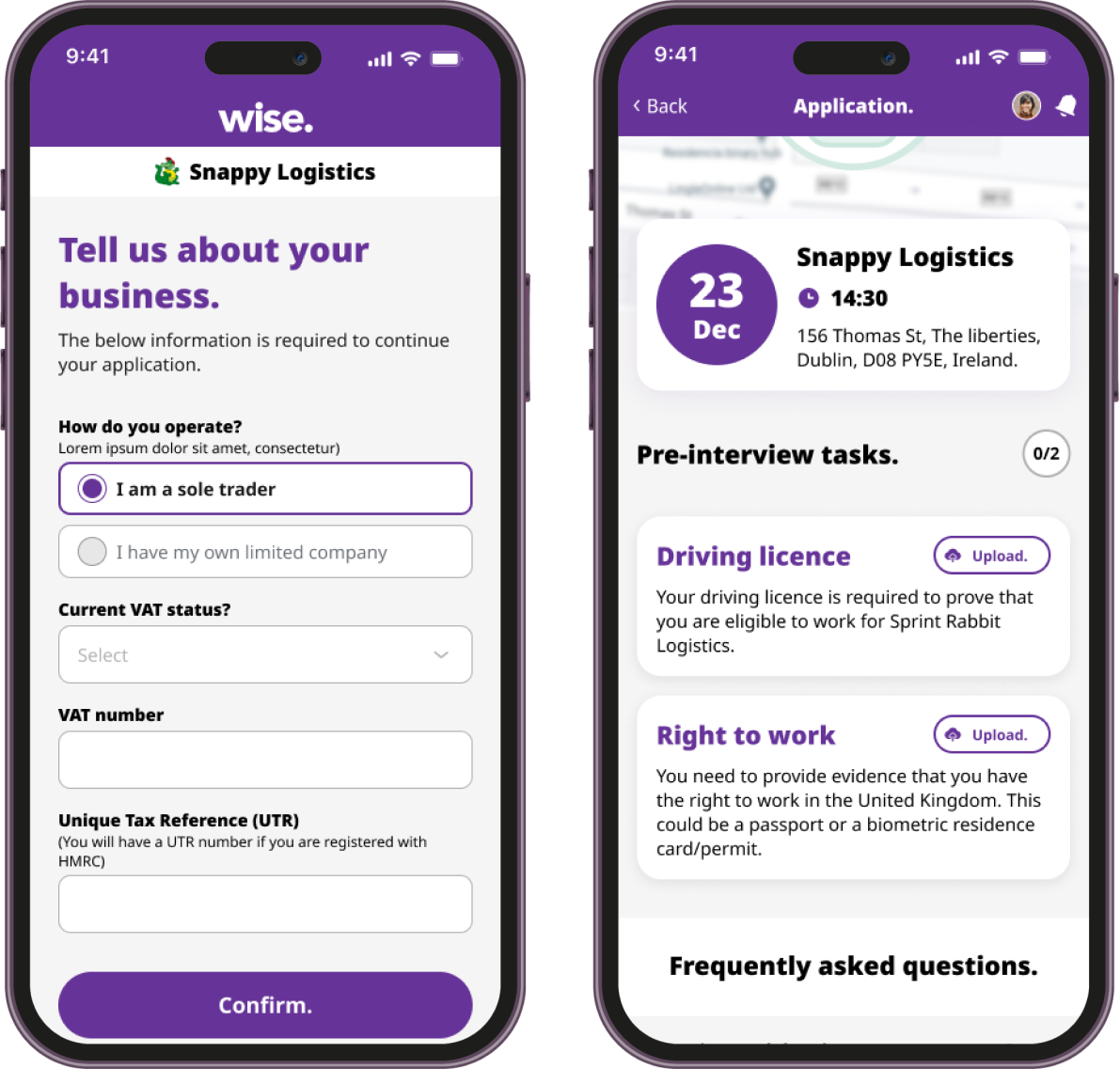

Wise can help you!

Understanding how Labour’s employment law reforms will impact your business is essential to avoid misclassification risks and compliance issues. Our team of experts can help you review contracts, assess working relationships, and prepare for these changes.