Earlier this year, Shadow Chancellor, Rachel Reeves, announced that the government will invest £555 million in HMRC to fund the recruitment of additional tax inspectors to focus on more complex tax avoidance and tax evasion cases.

Why the focus on tax now?

The newly announced policy to invest more in tax compliance by the Labour Party is set to drive significant investment into tax compliance enforcement, meaning HM Revenue & Customs (HMRC) will be intensifying its scrutiny of taxpayers like never before. The Labour Government has stated that they could save £6 billion a year by tackling tax avoidance and tax evasions. Key points driving the focus:

- A £36 billion tax gap – the difference between what’s owed and what’s actually collected.

- Declining compliance yield – HMRC’s estimated additional tax collection from its efforts has dropped from 5.8% to 4.2%.

- £13 billion in unrecovered tax revenue remains outstanding.

- Tax debt has surged to £43.9 billion, compared to £15.5 billion in December 2019.

These figures underscore the urgency for action to improve tax compliance and recovery.

What does this mean for businesses?

Companies may find themselves under investigation for a range of reasons, as HMRC aims to ensure compliance with the UK tax system, identify discrepancies, and recover any unpaid taxes. The new policy that Labour has announced will likely lead to more investigations and disputes, as taxpayers—both individuals and businesses—will face increased scrutiny, which could also lead to longer and more disputable enquiries.

What does this mean for logistic businesses specifically?

Following Labour’s victory, it’s anticipated that the number of compliance officers will rise by 5,000, aimed at boosting investigations, combating fraud, and ensuring tax liabilities are collected.

The status of self-employed drivers has been a point of contention in the UK for some time, especially within the gig economy. The logistics sector has traditionally relied on self-employed drivers, but recent legal challenges and growing calls for reform could have a major impact on businesses in this area. Labour has expressed support for enhancing workers’ rights, which may lead to changes in how self-employed drivers are classified and treated legally.

Adapting and keeping businesses on top of these changes will be a major challenge for logistics companies, which will need to plan for higher taxes and adjust their workforce models to meet new employment laws.

While courier companies will still rely on self-employed contractors, Labour intends to reform certain employment laws to provide greater protection and enhance workers’ rights. This makes it crucial for businesses to ensure they are treating their workforce fairly. Reclassification of your workforce can lead to significant financial consequences, including high penalties and the obligation to compensate contractors for any breach of their employment rights.

What Questions Might You Face During a Tax and Accounting Investigation?

- Do you fully understand the Employment Status and Off-Payroll IR35 rules?

- How do you determine an individual’s employment status?

- What employment status category does each individual you engage with fall into?

- How many self-employed contractors are currently engaged by your business?

- How many individuals are engaged through a limited company?

- What checks do you carry out to ensure your payments comply with tax regulations?

- Are the invoices provided and processed through a 3rd party on behalf of your drivers compliant and thoroughly reviewed?

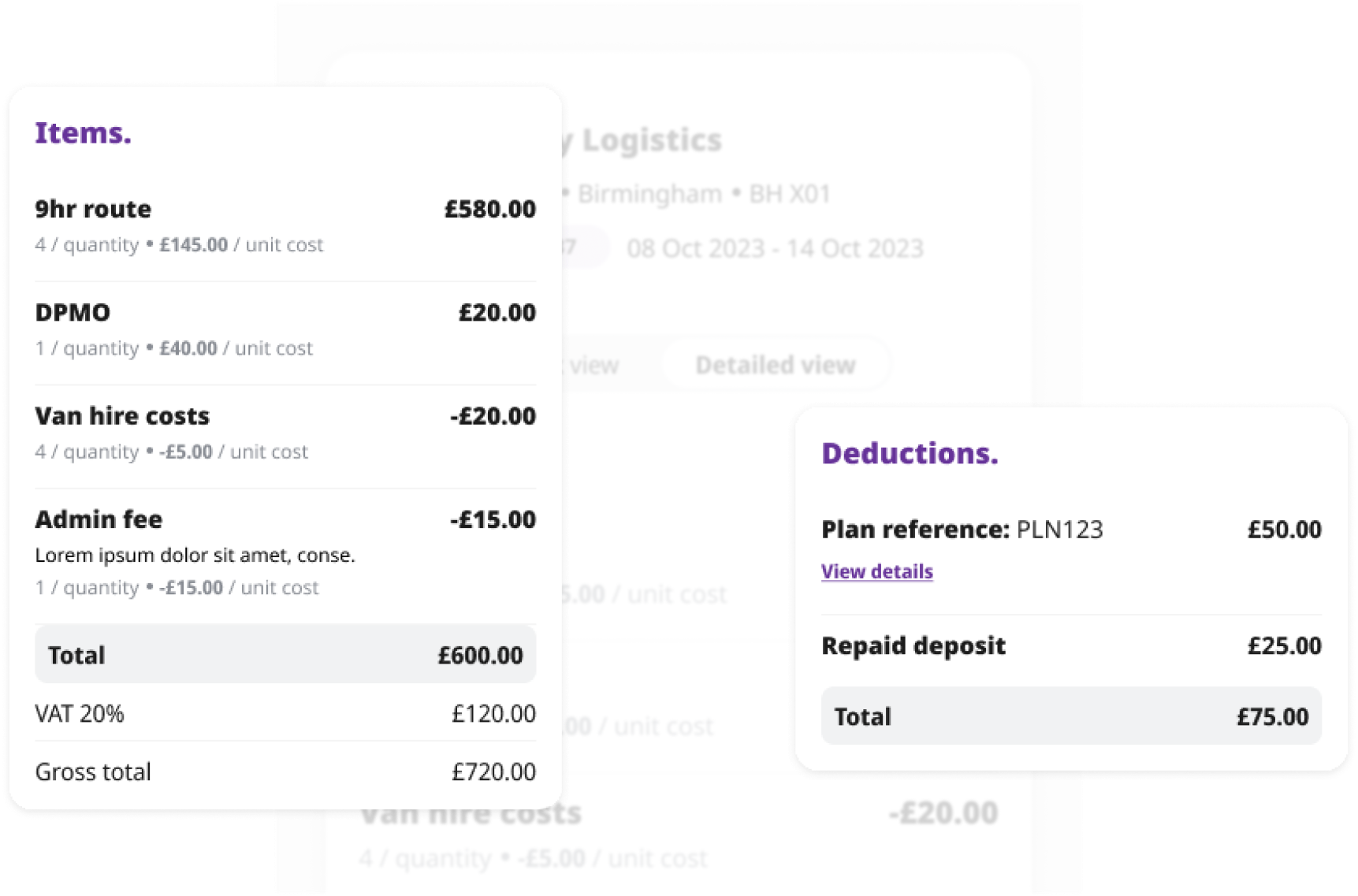

- How is VAT handled when drivers incur expenses or are charged for hired tools, such as for hired vehicle costs?

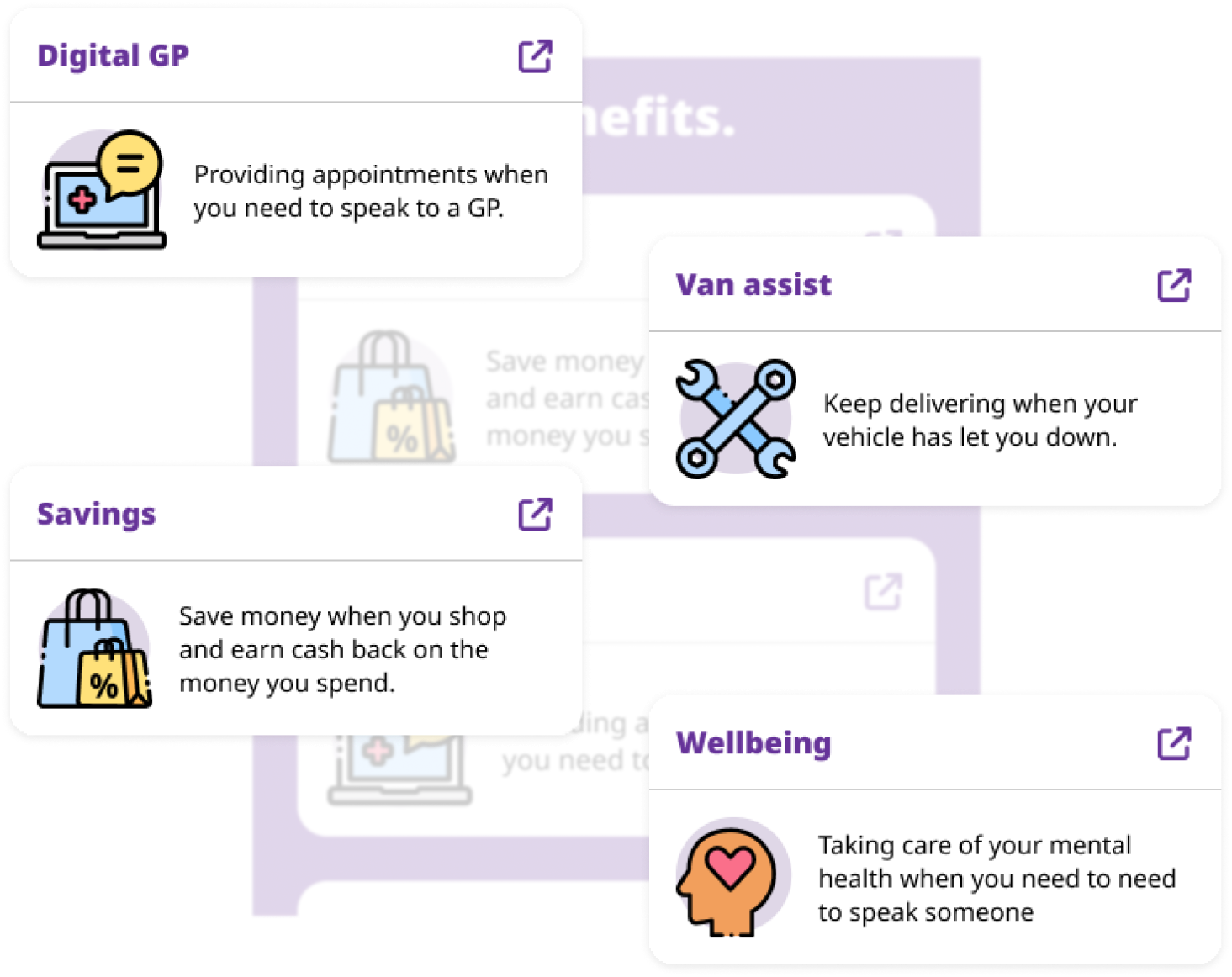

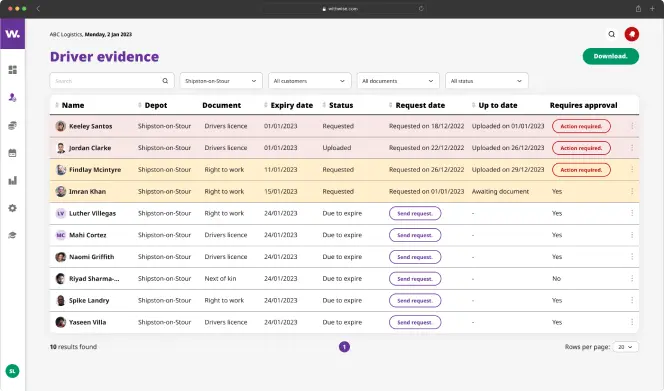

These are just a few of the critical questions that may arise during an HMRC investigation. But don’t worry – we’re here to help. Our platform offers comprehensive support, providing you with the tools and resources to keep accurate records of your accounting and workforce engagements, ensure your business stays compliant, and avoid the risks of costly tax disputes and penalties.

How can Wise help?

At Wise, we’ve helped clients navigate the complexities of HMRC investigations, offering solutions that ensure your records remain compliant. Our platform makes it easier for you to:

- Maintain accurate documentation for all payments processed through the Wise system

- Compliantly make deductions from drivers’ pay

- Ensure that your driver relationships remain tax-compliant and you do not jeopardise their employment status

With the new legislation in place, we anticipate an increase in investigations, potentially extending to smaller businesses, which could lead to more tax disputes. With our support at Wise, we can provide you with the knowledge and protection you need to properly engage your self-employed contractors, ensuring compliance with employment status rules for tax purposes.

Prepare your business for the increased scrutiny coming your way. Get in touch with our compliance team to learn how we can support your tax compliance and mitigate the risks of an HMRC investigation, whilst protecting the employment status of your engaged drivers.