Wise aims to ensure your business is legally compliant by following internal guidelines and legal requirements across both Employment and Tax laws in the UK.

When we review a Service Level Agreement (SLA), also referred to as a Contract for Services, certain key areas should be considered when determining Employment Status for Tax and Employment Law purposes.

Having the appropriate SLA is the best way to guarantee that your business is compliant. This helps all parties engaged in the agreement understand their obligations and rights, establishes both parties’ status and roles from the start of the engagement and promotes a good relationship between the self-employed driver and the company engaging them.

An SLA, or Contract for Services, is a contract that specifies the type of service that will be performed by a subcontractor and the level at which it will be performed. Implementing this will allow both parties to agree and acknowledge the terms of their position and the company rules whilst also establishing what is expected from a self-employed contractor and what their responsibilities are.

The downside of not having a correctly structured contract is the potentially mistaken assumption that one of the parties may be an employee or worker, thereby breaching their employment status.

Common characteristics of a Service Level Agreement:

A Contract for Services must mention and clearly state the nature of the business and the engagement and also explain what is expected from a self-employed driver and your company.

In a Contract for Services where the recipient is self-employed, the main aspects of being self-employed should be covered to satisfy the employment status of the contractor, and these are: control, mutuality of obligation, and substitution.

- Control: Your subcontractor’s method of working is entirely their own. Your company should not attempt to supervise, direct, control or retain the manner in which the subcontractor (or any substitute utilised by the subcontractor) performs the services. Nonetheless, the subcontractor agrees to cooperate with the company and its client in respect of working hours and security to ensure the smooth delivery of the services.

- Mutuality of Obligation: Your company shall not be obliged to provide any subcontractor with any minimum amount of services, and the subcontractor will not be obliged to accept or perform any such works or provide services. The subcontractor is free to decline to provide their services at any time for any reason.

- Substitution: The subcontractor shall have the right to use a substitute where they are unable or unwilling to perform their services. Where a substitute or hired assistant is used by the subcontractor, there shall be no contractual or financial relationship between the company and the substitute. The self-employed individual is solely responsible for arranging payments to the substitute to ensure that such person(s) possesses the necessary skills, qualifications, and licences to perform the services.

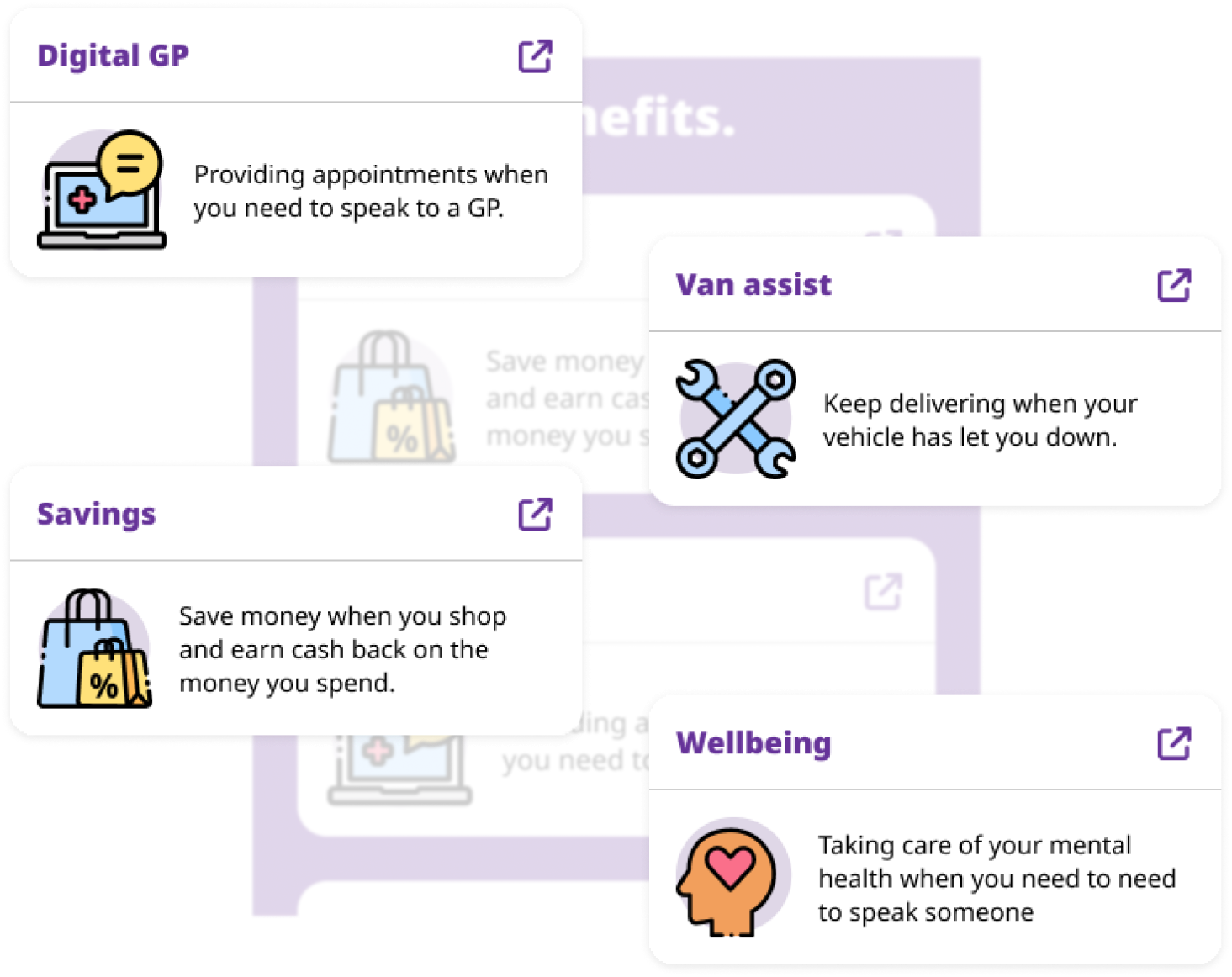

At Wise, we have a compliance team that will review your contract for services and either assist you in making the contract compliant or provide you with a new one – for FREE.

If you’re interested in learning more about how Wise can help you ensure your logistics business is compliant, click here.