- Key Takeaways:

- What is self-billing?

- Who is responsible for the accuracy of the self-billing invoice?

- The difficulties of self-billing

- Consequences of incorrect self-billing

- How Wise can support

Key Takeaways

- Self-billing allows companies to raise invoices on behalf of drivers.

- Businesses must meet specific HMRC requirements to ensure compliance.

- Failure to follow the rules can lead to fines and VAT complications.

- The Wise app simplifies invoicing for logistics firms and drivers.

What is self-billing?

Self-billing is when a company generates invoices on behalf of its drivers instead of the driver issuing them directly. However, there are key requirements that businesses often overlook.

The rules of self-billing

Logistics companies can implement self-billing with their drivers if they meet the following conditions:

- A self-billing agreement must be in place between the company and each driver.

- The agreement must be reviewed and renewed every 12 months to remain valid.

- Companies must verify the drivers’s VAT number to ensure it is correct and active.

Additionally, the logistics company (not the driver) is responsible for:

- Keeping records of all drivers who participate in self-billing.

- Ensuring invoices are correctly issued with the right information.

For whatever reason, if a driver stops being registered for VAT then you can continue to self-bill them, but you can’t issue them with VAT invoices (and you cannot claim any input tax). Your self-billing arrangement with that driver is no longer covered by the VAT regulations. Which can cause unnecessary headaches down the line as you have to put the trust in the drivers to inform you they are no longer VAT registered.

The self-billing agreement

For self-billing to be valid, the driver must agree in writing. Without this, self-billed invoices will not be valid VAT invoices, and businesses cannot reclaim input tax.

A formal self-billing agreement must include:

- The driver’s consent to allow the company to issue invoices on their behalf.

- Confirmation that the driver will not issue VAT invoices for services covered by the agreement.

- An expiry date, typically 12 months or aligned with the contract duration.

- The driver’s commitment to notify the company if they deregister for VAT, obtain a new VAT number, or transfer their business.

- Any details of third-party involvement in the self-billing process.

Who is responsible for the accuracy of the self-billing invoice?

The company issuing self-billed invoices is responsible for ensuring accuracy. However, drivers should still review invoices they receive. If errors are found, the driver must notify the company, which must issue a correction.

The difficulties of self-billing

Self-billing presents several risks, including:

- High risk of errors – incorrect invoice details and VAT miscalculations.

- Significant confusion – misunderstandings about VAT obligations.

- Weak audit trails – missing or duplicate documents.

- Incorrect VAT rates – applying the wrong rate or issuing VAT invoices to non-VAT-registered drivers

- Breaching conditions – such as a driver deregistering for VAT without informing the company.

As stated by the Tribunal chairman in UDL Construction Plc: “I regard the self-billing procedure as a gross violation of the integrity of the VAT system… It permits a customer to originate a document which enables him to recover input tax and obliges his supplier to account for output tax. It goes without saying that such a dangerous procedure should be strictly controlled and policed.”

Consequences of incorrect self-billing

Failure to comply with HMRC’s self-billing requirements can result in:

- Fines and penalties for improper VAT handling.

- Incorrect VAT charges leading to financial losses.

- Large VAT bills if input tax is reclaimed incorrectly.

How Wise can support

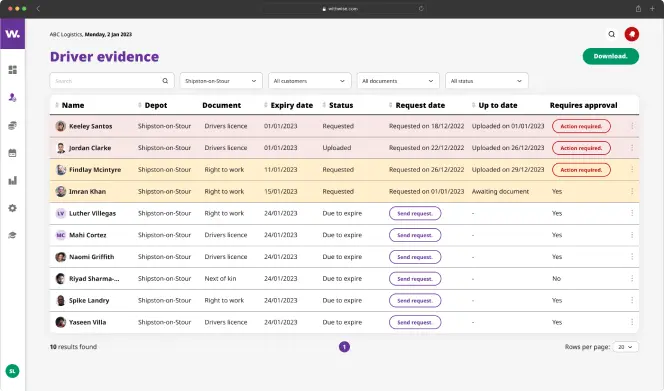

At Wise, we’ve worked with hundreds of logistics businesses and found that many struggle to meet all three self-billing requirements.

The Wise app removes this risk by allowing drivers to create and send their own invoices directly to the companies they work for. This ensures compliance, reduces administrative burdens, and shifts the invoicing responsibility away from your business.

For more information on how Wise can streamline your invoicing process, get in touch today!