Supervision, direction, and control are commonly discussed when determining subcontractors’ employment status. This article will discuss what SDC means as we recognise it can be a tricky topic to understand.

It is essential to have a clear understanding of HMRC’s rules of Supervision, Direction and Control (SDC), as they are used to determine whether ‘agency legislation’ applies to workers.

Supervision, Direction & Control is covered within two pieces of different legislation from 1978 and 2003.

This agency legislation means an agency or an employment intermediary needs to examine an individual’s self-employment status and this also states that if the individual is affected by SDC, then they must be placed on the payroll.

What does Supervision, Direction and Control mean?

Supervision – If supervision is in place, it means there is someone overseeing another person carrying out the work to ensure it is being done correctly and to a high standard. Supervision is also relevant if an individual is aiding or assisting another person to develop their skills and knowledge within the workplace.

Direction – Entails an individual making another person do their work in a specific way, usually by providing directions, assistance, and advice on how they want the work to be completed. When working under direction, it is common for someone to coordinate how the work is being undertaken, whilst it’s being done.

Control – There will be someone telling individuals what work they should be doing and how they should be doing it, they may also be able to change the worker’s tasks if priority changes.

A key point to note is that supervision, direction and control are relevant if any of the three factors applies to a subcontractor. For example, a subcontractor may not be controlled or supervised, but if they’re directed, or if there is the right of direction, then SDC applies.

How to keep up Supervision, direction and control best practice

It is essential that main contractors adopt ‘Supervision, Direction and Control best practices’, main contractors that are seeking to stay outside of SDC are advised to:

- Check that there is no mention of SDC in your contract. HMRC will look to see what happens in practice, but it is crucial that the contract and what happens are consistent.

- Receive confirmation of arrangements to be signed by both parties that confirm the working arrangements – this should verify that the features associated with SDC are not present.

- Keep an SDC document for each contract, this will include the same emails, meeting notes and phone conversation notes as an IR35 document. This could act as substantial proof that could stop an HMRC investigation before it even has begun.

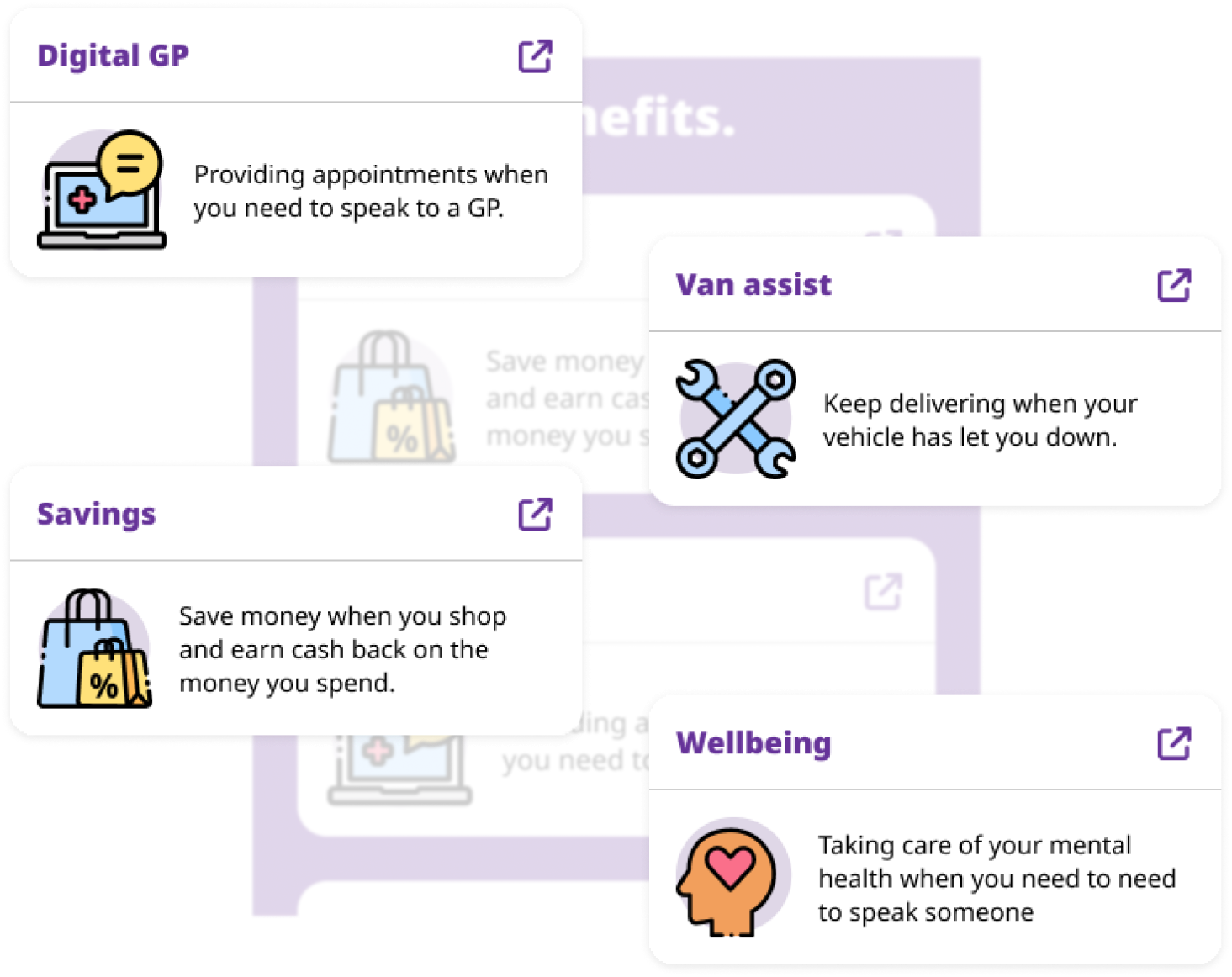

At Wise, we partner with a specialist accountancy company that can advise you on the employment status of your drivers Book a FREE demo here to arrange to speak to one of our experts.