Mutuality of Obligation, also known as MOO, is an essential factor in employment law. This factor also plays a key role in determining employment status during IR35 investigations and other employment law cases. In this article, we will discuss what Mutuality of Obligation is and the different tests involved, should HMRC be concerned about a subcontractor’s employment status.

What is Mutuality of Obligation (MOO)?

Mutuality of Obligation refers to a relationship between a business and an individual where there is an ongoing relationship between them for the company to hand out work or tasks to the individual and an expectation for them to complete this within their role (like a typical employer / employee relationship). This is a common test used in tax investigations and employment status tribunals to determine a subcontractor’s employment status and whether they owe any tax.

If Mutuality of Obligation is present, then the relationship between the contractor and end-client may reflect employment, meaning the contractor may be deemed to fall inside of IR35.

The Test

The test for mutuality of obligation has two key elements that must both be present:

- A client was compelled to offer the individual work, and

- That person is required to accept the work offered

When both factors are present, this provides a clear sign that the contract could be one of employment, whereas if one or both factors are absent, this errs on the side of a self-employed relationship.

Mutuality of Obligation and Employment Law

The traditional relationship between employee and employer is one where the employer is obliged to pay the employee for the work done and also give them work moving forwards. The employee is also obliged to complete the work, and typically will not be able to decline tasks that fall within their role.

However, if you’re self-employed and working with a main contractor, this kind of mutual relationship should not exist, meaning that your client should only be engaging a subcontracted company or supplier to complete a specific task for them. Once the task is complete, the subcontractor is then free to move on and work with another client, rather than the main contractor being compelled to offer additional work moving forwards.

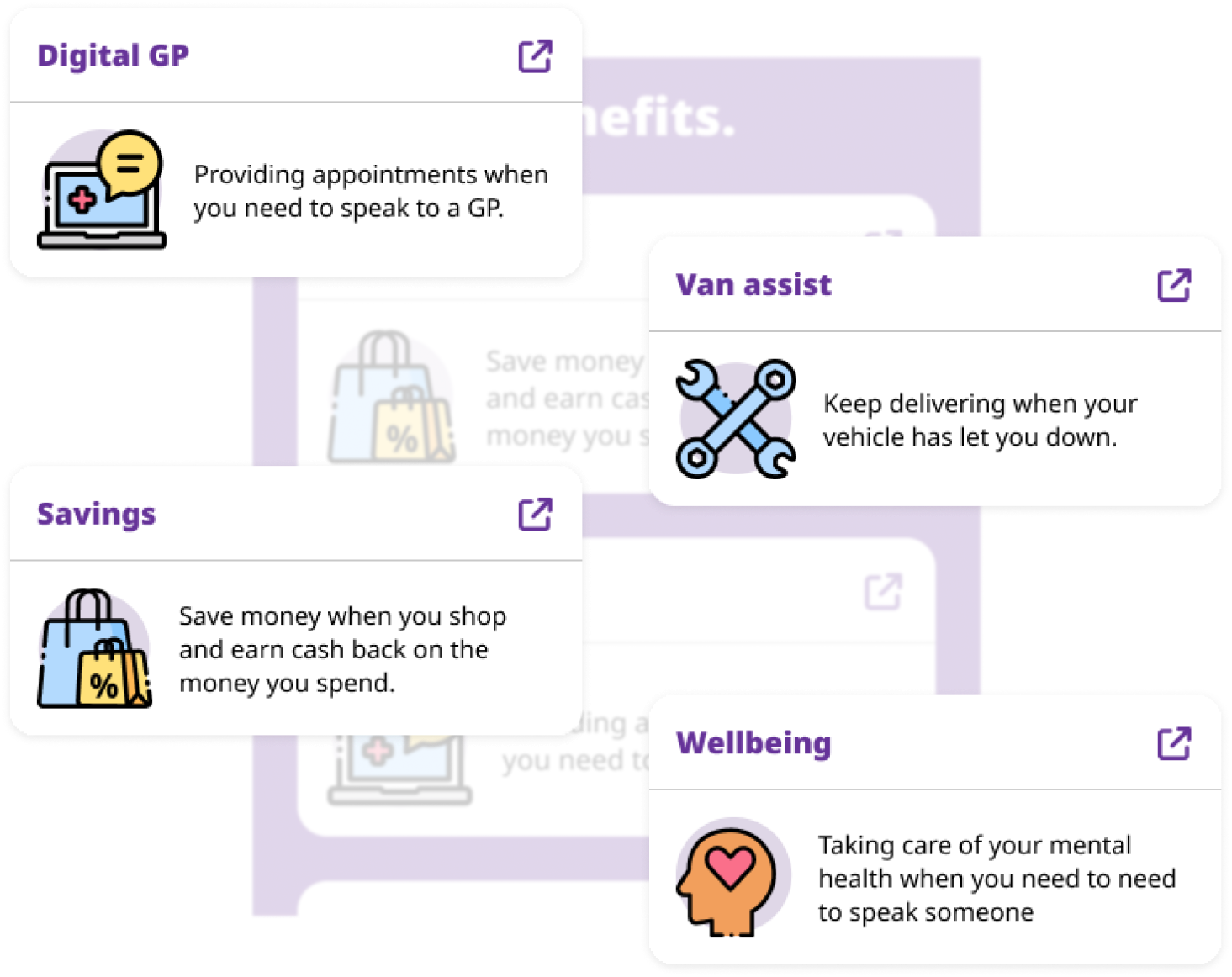

At Wise, we’re experts in all aspects of self-employment and are able to offer our clients industry-leading advice on all aspects of employment status and tax law. To find out more about how Wise can help your business better engage self-employed subcontractors, book a FREE demo with one of our experts, here.