Payday, this should be a day when everyone looks forward to the excitement and joy of a job well done. While this is true for many, when you’re in charge of the payroll process yourself – it can become more of a dreaded day than a reason to be excited about.

Paying people the right amount and on time is a lot more difficult than it looks, and it is a crucial part of all businesses. Constant payroll mistakes and delays have a big effect on businesses, leading to high turnover rates.

Typically, in the last-mile industry, paying self-employed drivers has always been time-consuming and difficult. With drivers working different routes, being paid different hourly rates, and working between multiple courier companies, it can be stressful.

Streamline your driver payroll process

Processing payroll information is not a quick task: double-checking all figures, making sure driver information is correct, and so much more! It has a reputation in the logistics sector for being one of the most stressful and laborious tasks.

Understanding how to streamline paying self-employed drivers is essential to improve the efficiency of courier businesses.

1. Digitise driver records

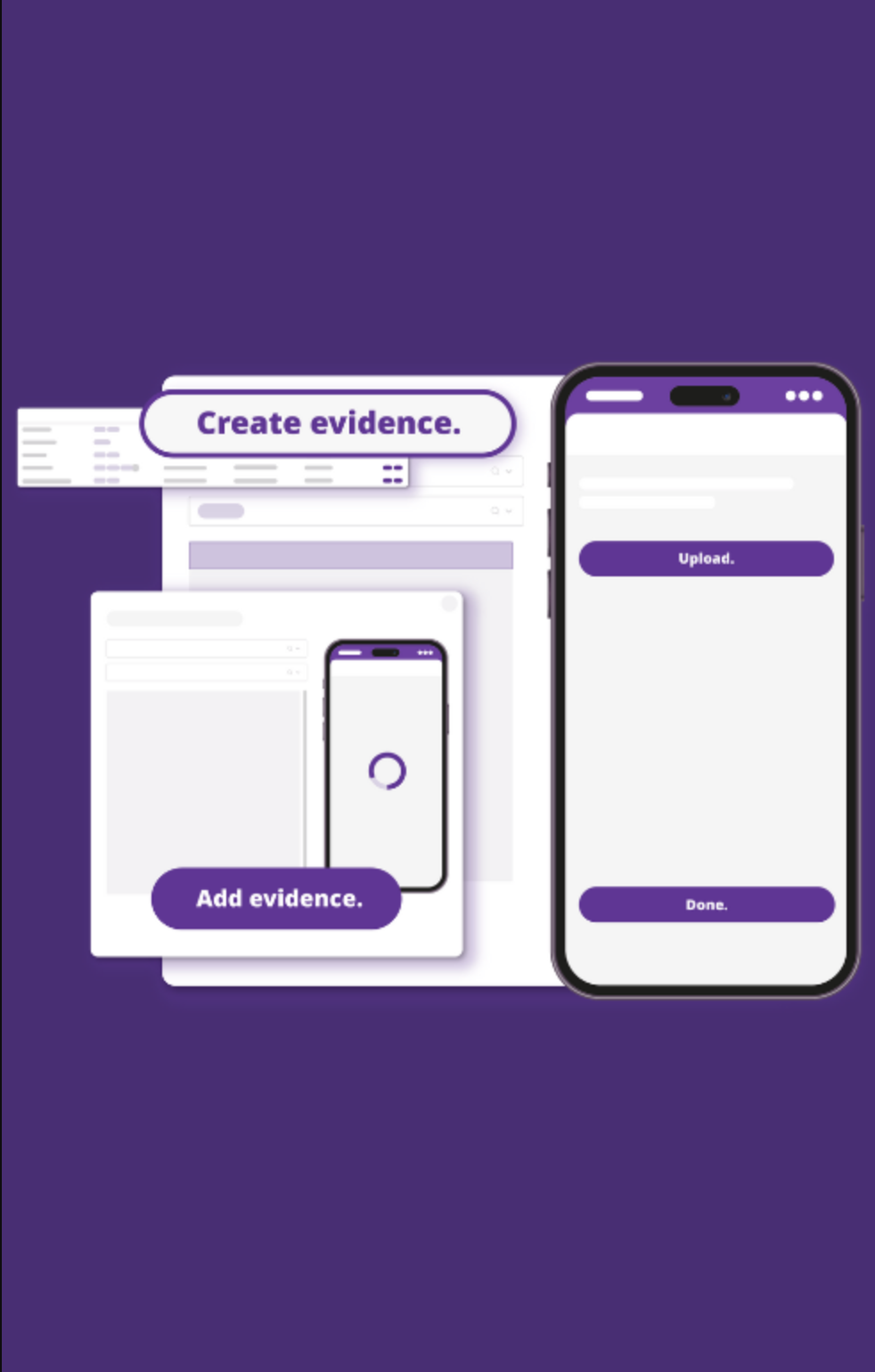

Digitising driver payroll and completely eliminating paper documents not only saves effort and time in sorting through paperwork and timesheets but also makes it easier to keep track of information. Mistakes are very common when using Excel spreadsheets or multiple systems to process self-employed drivers’ pay. Using one digital system can help you prevent chaos each time payroll is due.

2. Centralise driver data and information

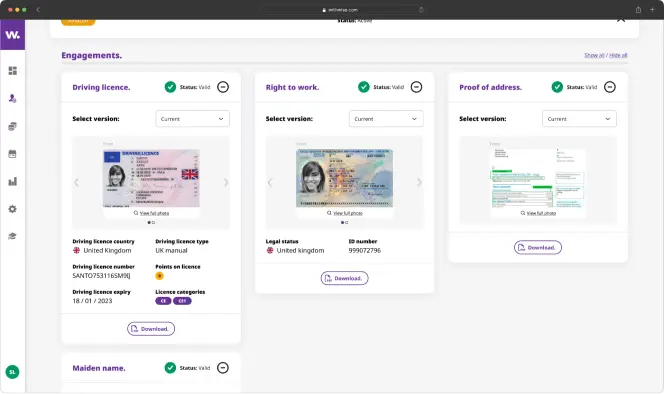

From a compliance perspective, keeping driver information up to date is critical – storing all driver documentation in one place rather than several locations will help save time and reduce the risk of losing any sensitive information.

Another benefit of centralising payroll for self-employed drivers is that you can look at payroll data in real-time, removing the need to wait for batch processing to see changes that need attention.

4. Provide a seamless driver experience, reducing admin effort

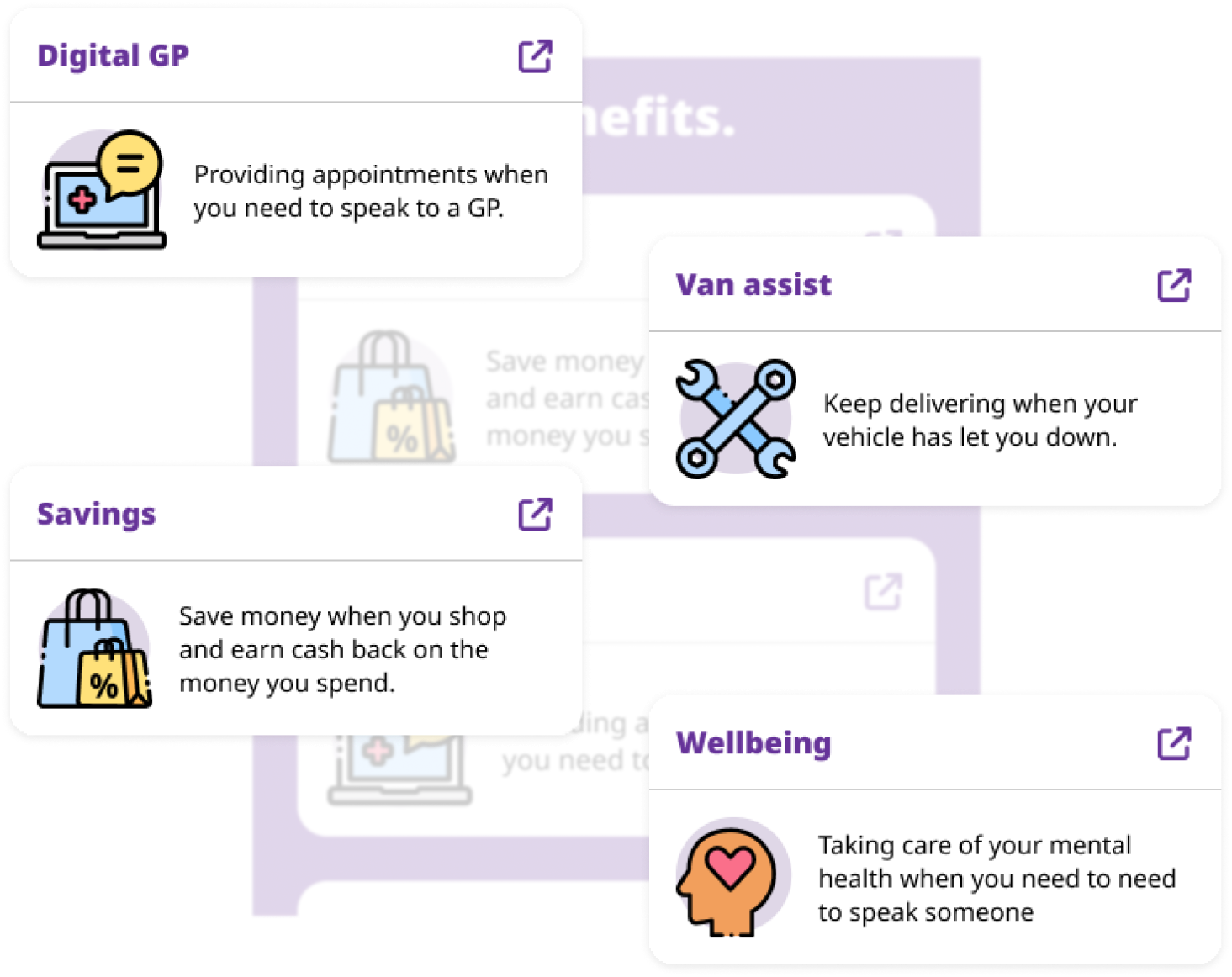

Using digital software to pay self-employed drivers not only reduces admin effort for courier businesses but also provides self-employed drivers with a more seamless experience. Typically, using digital software provides self-employed drivers with more flexibility by allowing them to see upcoming payments ahead of payday, so they can have more control and oversight over their personal finances, which can lead to reduced financial stress and increased productivity.

Wise’s All-In-One Driver Payment Solution Say goodbye to spreadsheets

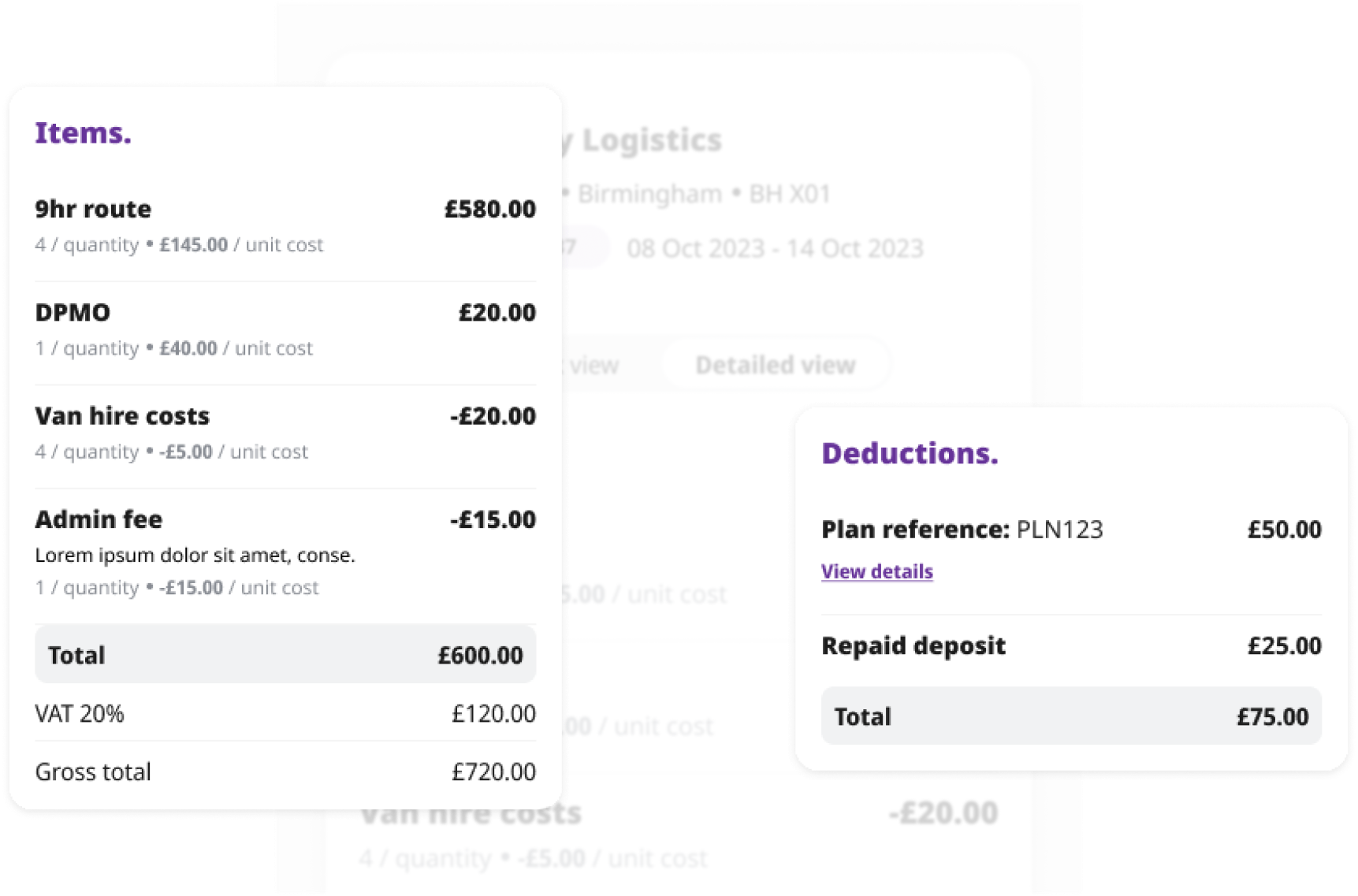

The Wise Platform removes all the payment headaches by simplifying the whole process. Our cutting-edge platform does all the hard work; all you need to do is transfer one sum of money, and we distribute the correct pay out to your self-employed drivers.

Through the accompanying Wise Driver app, self-employed drivers are able to see their forthcoming payments and query amounts, meaning there is total visibility of the payments that are due and when they will be paid.

Because Wise provides total flexibility in managing payments, courier businesses can have total flexibility in how they want their driver invoicing to be set up, create default route rates, and add payment information – all cutting down on weekly billing admin.

Looking to get started?

Request a 15-minute call to speak to one of our product experts, who can take you through our Payment Portal in more detail.