Last month, HMRC launched a new direct letter campaign, sending out thousands of “nudge” letters to people who earn vast amounts from selling goods or services online, or who receive value for creating online content.

Letter types

Two different types of nudge letters have been sent to two specific categories of taxpayers.

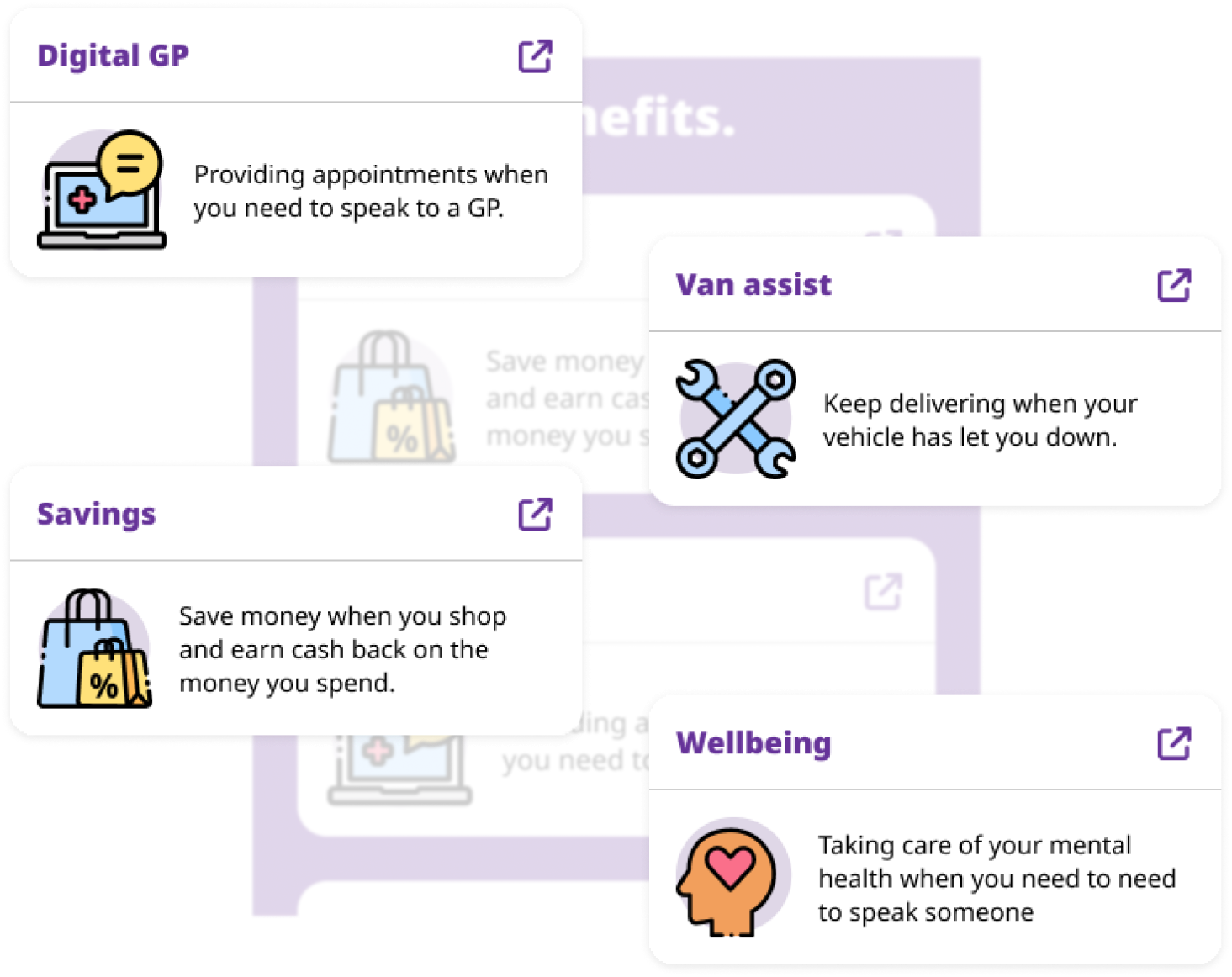

The first letter has been directed to those who sell goods or their own services through marketplaces. This includes people who sell items on eBay or Etsy, taxi drivers who find their rides through platforms such as Uber or Lyft, and self-employed drivers.

The second letter was dispatched to people who create online content and generate money from that type of work; authors and influencers may fall into this category.

Why is this important?

The nudge letters acknowledge that HMRC is aware that the individual has not declared all or part of their income from online sales or from creating content on digital platforms.

However, HMRC has told the Chartered Institute of Taxation that the letters are only being sent to individuals they have information on, who have traded and earned more than £12,570 from their online sales.

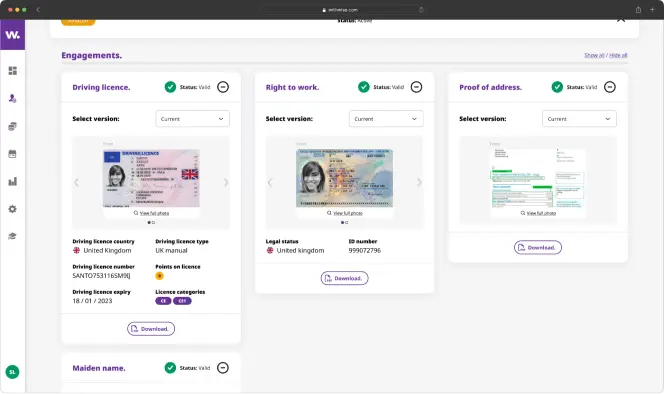

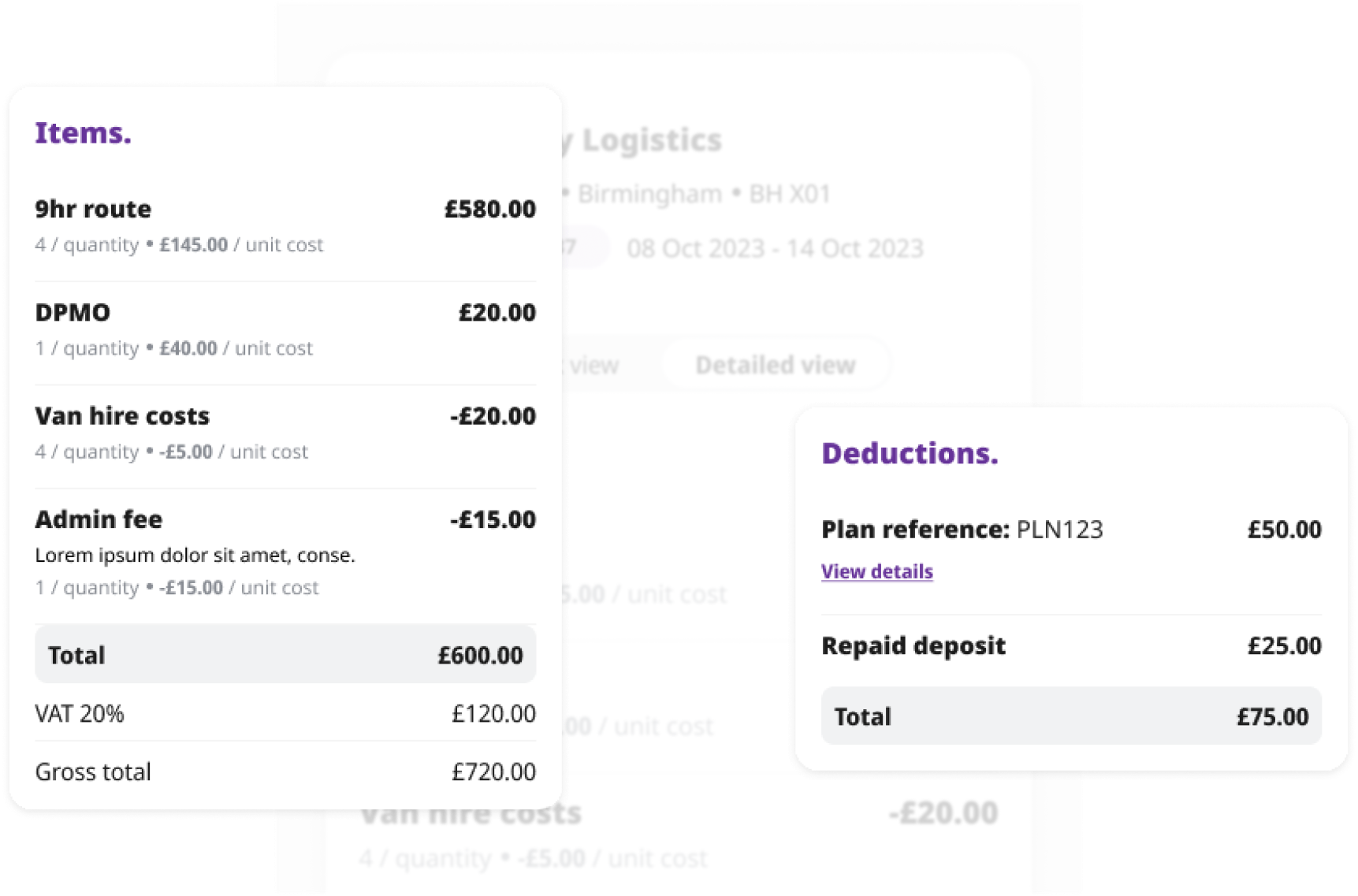

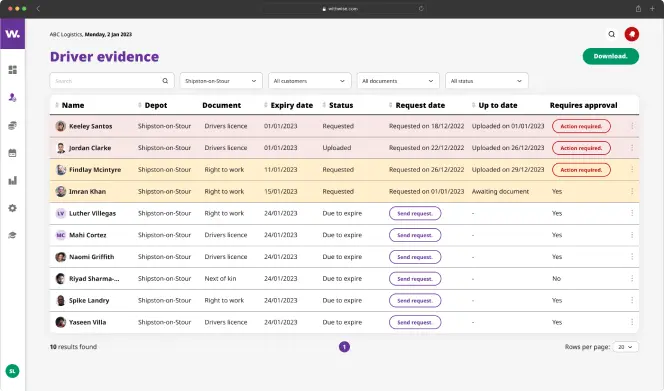

Employment status and tax within self-employment can often seem complicated, Wise works with over 250 UK businesses and supports 60,000 self-employed drivers to ensure they’re fully compliant and don’t end up with any HMRC headaches, contact us here to learn more!