Table of Contents

- Consequences of misclassification risks and compliance issues

- How to prepare for Labour’s Employment Law Changes?

- How can Wise support you with Labour’s upcoming changes?

Understanding how Labour’s employment law reforms will impact your business is essential to avoid misclassification risks and compliance issues. Although the reforms are yet to be finalised, our team of experts can help you review contracts, assess working relationships, and prepare for these changes.

Consequences of misclassification risks and compliance issues

Misclassifying self-employed contractors or failing to address compliance issues can have serious repercussions for your business.

When individuals are self-employed, they relinquish their right to the following statutory employment rights:

- Statutory sick pay;

- Maternity, adoption and paternity leave and pay;

- Not be unfairly dismissed;

- Statutory redundancy pay;

- National minimum wage;

- Holiday pay;

- Limits on night work;

- Protection against authorised deductions from pay.

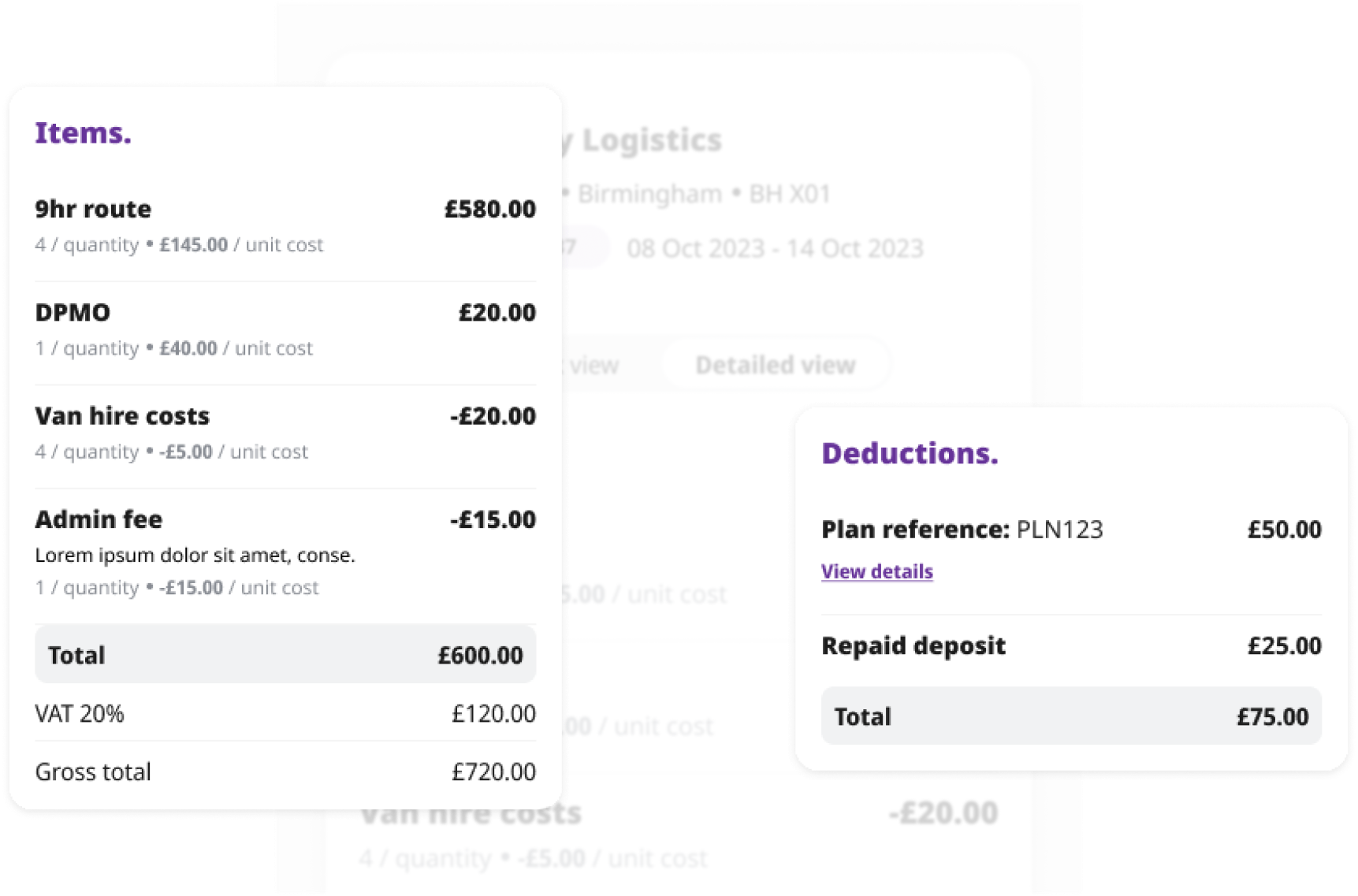

If your self-employed contractors are reclassified as employees for the entire duration of their engagement with your business, you would be legally obligated to compensate them for all these rights they were previously denied. Additionally, you would incur further costs such as employers’ National Insurance contributions and pension payments where applicable.

The financial implications of reclassification are significant and could pose a serious threat to the survival of your business.With upcoming changes made by Labour in employment legislation aimed at strengthening workers’ rights, the process of bringing collective claims through Acas will become more accessible. This increases the risk of a single reclassification leading to your entire workforce being reclassified as employees rather than self-employed contractors.

The Key Consequences of Misclassification and Reclassification Include:

- Financial Risks: High compensation costs for each reclassified contractor, including backdated pay, benefits, and employer contributions.

- Collective Claims: Increased risk of group claims against your company.

- Reputational Damage: Negative publicity and a tarnished reputation that could impact client and contractor relationships.

How to prepare for Labour’s Employment Law Changes?

Review your Contract For Services

The contract between your business and your self-employed contractors is crucial in determining their employment status and defining their rights, responsibilities, and expectations.

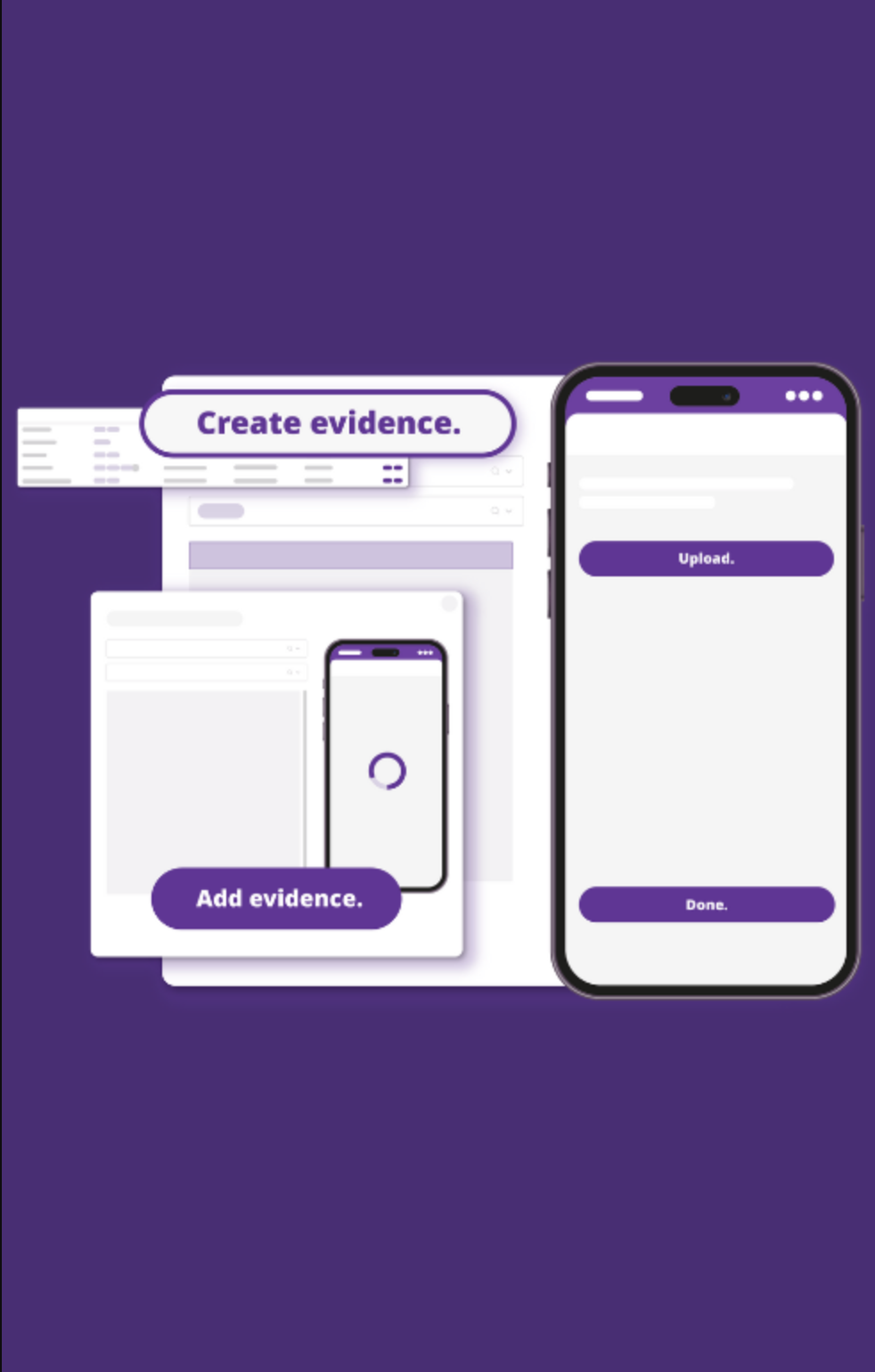

A Contract for Services serves as an agreement between both parties. It is a key piece of evidence that clearly defines and demonstrates the working relationship between both parties.

Your first step should be to review your Contract for Services to ensure it thoroughly addresses all key aspects of self-employment. Additionally, it must be compliant with regulations and accurately reflect the realities of the working relationship you have with your self-employed contractors.

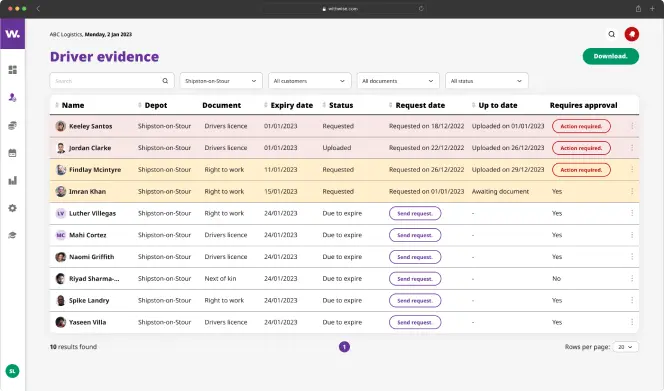

Assess your working relationships with your self-employed contractors

After reviewing your Contract for Services, it’s important to assess the actual working relationship with your self-employed contractors to ensure it aligns with what is outlined in the contract.

If the written terms do not match the reality of the working relationship, your business could face potential tribunals.

How can Wise support you with Labour’s upcoming changes?

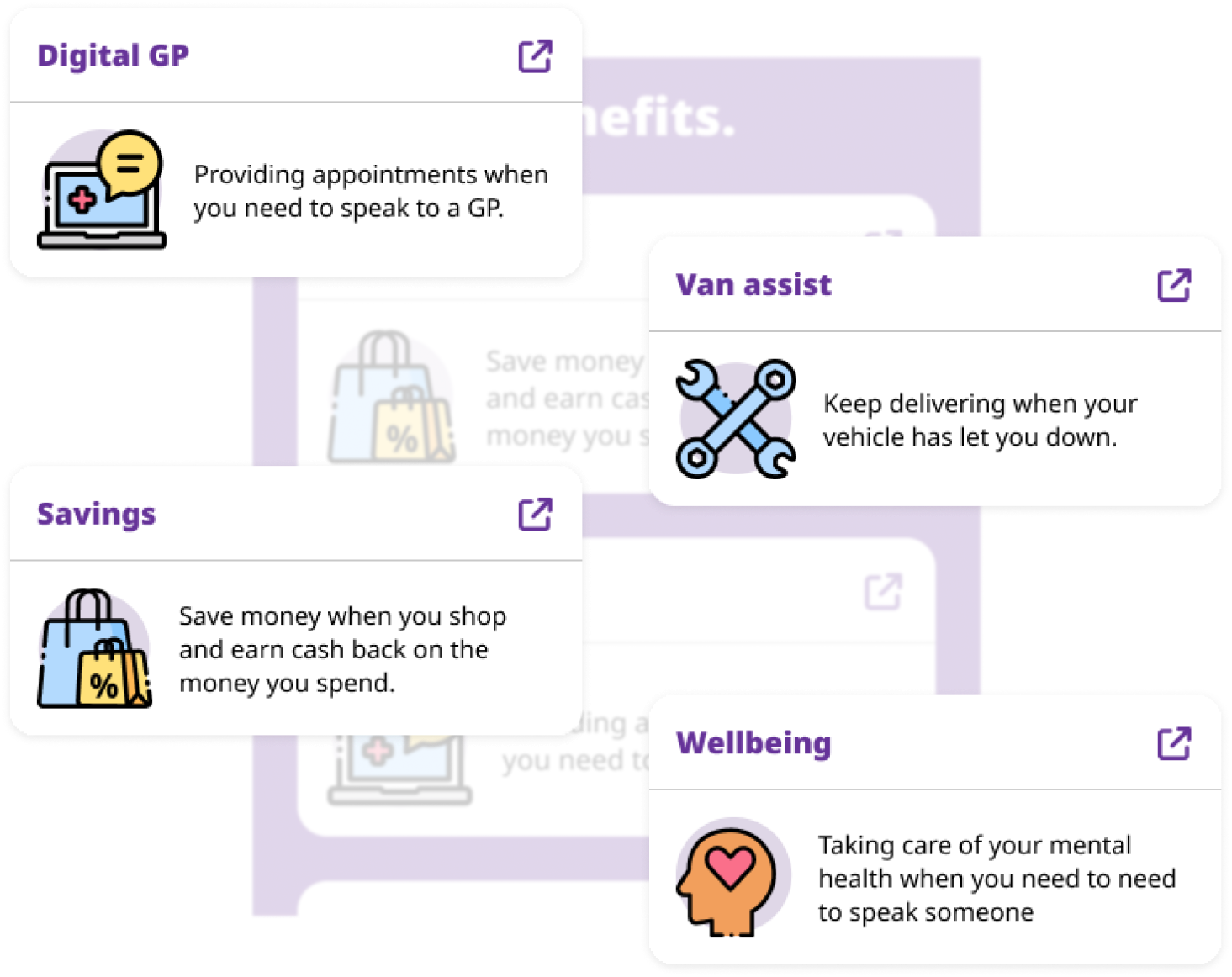

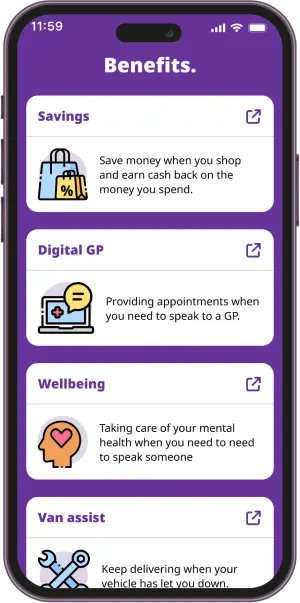

At Wise, we provide comprehensive compliance support and services to give you complete confidence in your business operations. With the new Employment Bill and employment law changes coming into effect, we are here to support you with the following:

- Tailored Contracts for Services: We can offer guidance to ensure your Contract for Services is compliant and tailored to your needs, as well as review any other contractual agreements between you and your self-employed contractors

- Risk Identification and Compliance Assistance: We’ll help you identify potential hidden risks within your business practices and provide compliance and employment law insights. This ensures your working relationships align with the terms of your engagements. Our compliance and employment law advice will provide insights into how to treat your self-employed contractors fairly while maintaining their correct employment status.

- Online content: We are able to review your online content – including social media posts, job advertisements, and your website – to ensure that you’re not posting roles that could jeopardize the employment status of your self-employed contractors or using terminology that might negatively expose you to ‘no win no fee’ solicitors or other legal authorities.

- Guidance on the main pillars of self-employment: We can assist in ensuring you are well-represented and protected from potential legal issues by providing guidance on compliance and employment law. Additionally, we will keep you informed about relevant legislative updates, giving you the knowledge to navigate changes with confidence.